Understanding Your CP283C Notice

We charged you a penalty for filing a late or incomplete Form 8955-SSA, Annual Registration Statement Identifying Separated Participants with Deferred Vested Benefits.

What you need to do

- If you agree, send the amount due by the date on your notice to avoid interest charges.

- If you disagree, contact us by mail or call 1-877-829-5500.

You may want to

- Review this notice with your tax preparer.

- Call us for assistance at the toll-free telephone number listed at the top right corner of your notice.

Answers to Common Questions

When is my Form 8955-SSA due?

Form 8955-SSA is due the last day of the seventh month following the end of your plan year.

Can I have the penalty removed or reduced?

We can consider reducing or removing the penalty under certain circumstances. Send a signed statement to the address shown at the top of the notice that includes the following:

- The penalty you would like us to reconsider

- The reason you believe we should reconsider it

- Your name and title

Understanding your notice

Your notice may look different from the sample because the information contained in your notice is tailored to your situation.

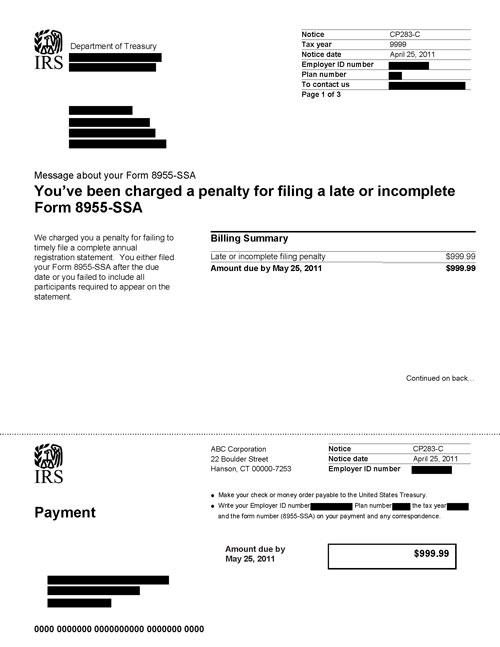

Notice CP283C, Page 1

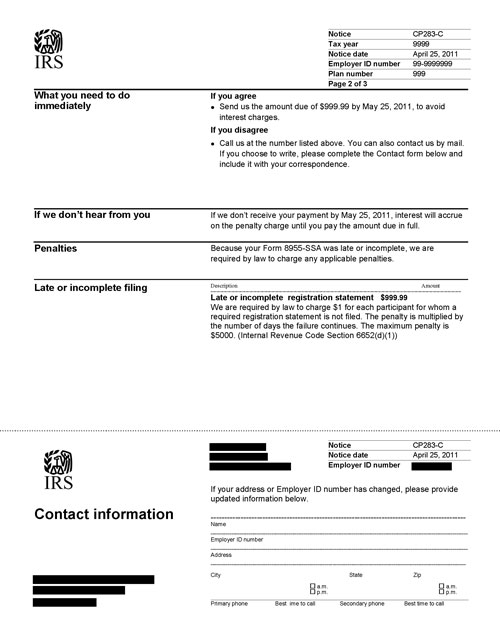

Notice CP283C, Page 2

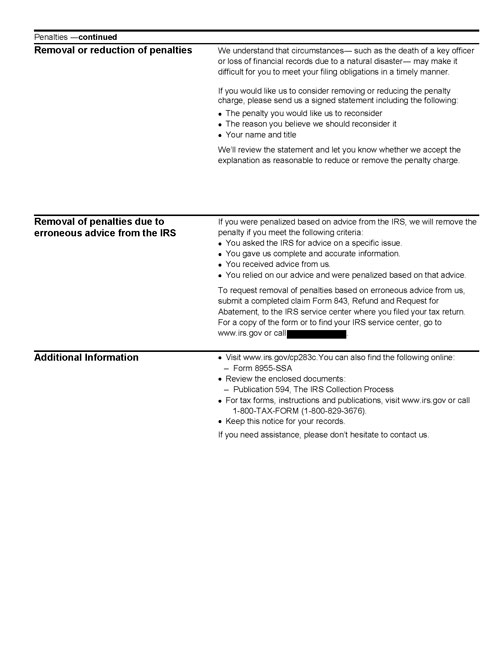

Notice CP283C, Page 3

Page Last Reviewed or Updated: 2013-01-03