Understanding Your CP30 Notice

We charged you a penalty for not pre-paying enough of your tax either by having taxes withheld from your income, or by making timely estimated tax payments.

What you need to do

- Review the amounts being withheld from your wages, pensions and annuities, and other sources of income. If the amount withheld is not sufficient, adjust it by filing new withholding certificates (Form W-4, W-4P, W-4S, or W-4V) with your employer(s) or other payer(s).

- Make timely estimated tax payments, if necessary, to ensure that you pre-pay a sufficient amount of tax through a combination of withholding and estimated tax payments. See Who Must Pay the Underpayment Penalty in the Form 2210 instructions for the amounts required to be paid.

You may want to...

- Complete Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts, if most of the tax withheld from your income was withheld early in the year. Electing to report withholding when it was actually withheld, instead of spreading it equally through the year, may reduce or eliminate the penalty.

- Complete Form 2210, Schedule AI, Annualized Income Installment Method, if you did not receive your income evenly through the year, and you received more than half of your income during the third and fourth quarters of the year. Annualizing your income may reduce or eliminate the penalty we charged.

- Request removal of the penalty if you retired in the past two years either because you were 62 or older, or because you became disabled, and you had reasonable cause for the underpayment, or for the late payment of your estimated tax. (See Waiver of Penalty in Form 2210 instructions.)

- Request removal of the penalty if the underpayment, or the late payment of your estimated tax, was due to a casualty, disaster, or other unusual circumstance that makes assessment of the penalty unfair. (See Waiver of Penalty in Form 2210 instructions.)

- Request removal of the penalty if the underpayment, or the late payment of your estimated tax, was due to specific written advice from an IRS agent given in response to a specific written request. You must provide copies of both the written request, and the written advice given in response.

Answers to Common Questions

How do I know if enough is being withheld from my income?

The IRS Withholding Calculator can help you determine if enough tax is being withheld. Publication 919, How Do I Adjust My Tax Withholding, is another good resource.

How much am I required to pre-pay in order to avoid a penalty?

You are generally required to pre-pay at least 90% of your tax either by having the tax withheld from your income, or by making timely estimated tax payments. A penalty will also not be charged if you pre-pay a "safe harbor" amount equal to 100% of the previous year's tax. However, special rules exist for certain taxpayers:

- Qualifying farmers and fishermen are required to pre-pay only 2/3 (66.67%) of their tax, or the safe harbor amount, whichever is less. You are a qualifying farmer/fisherman if at least 2/3 of your gross income in either the current or previous year is or was derived from farming or fishing. See Farmers and Fishermen in Publication 505 for more information.

- The safe harbor amount for high income taxpayers is 110% of the previous year's tax. You are a high income taxpayer if your previous year's adjusted gross income was $150,000 or more ($75,000 or more if you were married, filing a separate return).

You also will not be charged a penalty if your total tax due, after withholding, is less than $1,000, or if you had no tax liability for the previous year.

If I have to make estimated tax payments, when are they due?

Estimated tax payments are generally due on April 15, June 15, and September 15 of the tax year, and on January 15 of the next year.

For filers with a taxable year that ends in a month other than December, the payments are due on the 15th day of the 4th, 6th, and 9th month of the taxable year, and on the 15th day of the first month of the following taxable year.

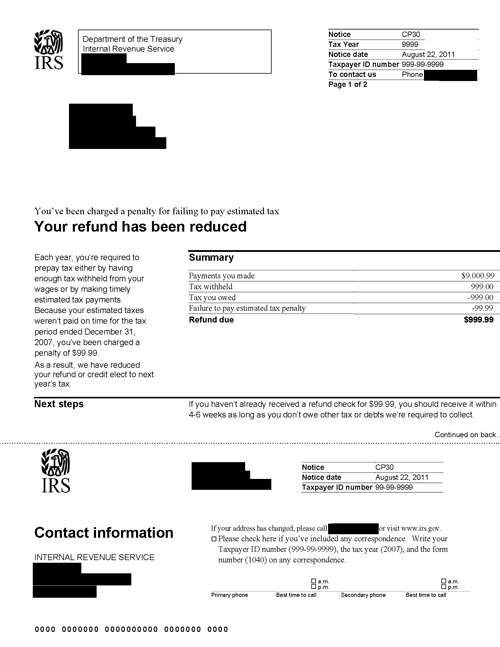

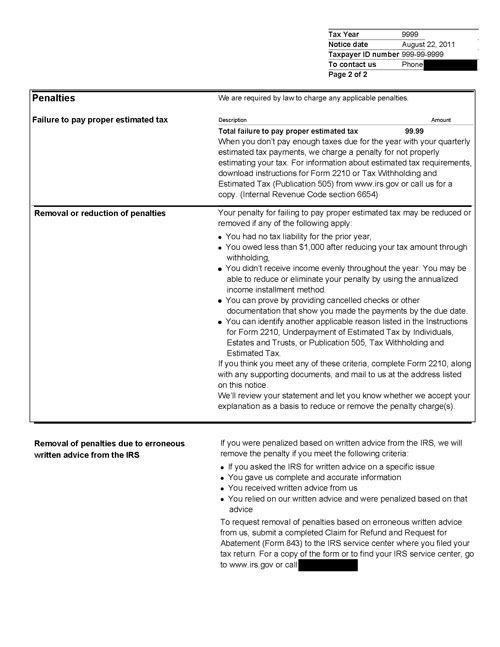

Understanding your notice

Reading your notice

Your notice may look different from the sample because the information contained in your notice is tailored to your situation.

Notice CP30, Page 1

Notice CP30, Page 2

Notice CP30, Page 3