Understanding Your CP3219N Notice

We didn't receive your tax return. We have calculated your tax, penalty and interest based on wages and other income reported to us by employers, financial institutions and others.

What you need to do

- File your tax return immediately, or

- Accept our proposed assessment by signing and returning the Response form, or

- Call us if you think you don't have to file.

You may want to…

- Use the income information included with the notice, along with other income you received to prepare your return.

- File your return to claim expenses and deductions you’re entitled to.

- To receive a refund, you must file the return within three years of the due date for the specific tax year.

- File your return to claim expenses and deductions you’re entitled to.

- Review what happens when you don’t file a tax return by going to the following web pages:

- Review your records and make sure you filed all your prior returns. Download copies of prior year tax returns and products.

- Download copies of the following materials (if they were not included with your notice):

- Call 1-800-829-3676 (1-800-TAX-FORM) to order forms and publications.

- Check to see that you have enough money withheld from your paycheck to pay your taxes. The IRS withholding calculator can help.

- Learn more about your payment options if you owe additional taxes on your return.

- Learn more about payment plans and installment agreements.

- Learn more about Offers in Compromise.

- Complete and send us a Form 2848, Power of Attorney and Declaration of Representative to authorize someone (such as an accountant) to contact us on your behalf.

Answers to Common Questions

What should I do if I disagree with the notice?

Call us at the toll free number listed on the top right corner of your notice. Please have your paperwork ready when you call. If you prefer, you can write to us using the notice's response form and return address listed.

Where do I send my return?

Attach the Response form and send the return to the address listed on the notice.

What should I do if I've just filed my tax return?

You don't have to do anything if you filed your tax return(s) within the last eight weeks.

What should I do if I didn't file my tax return or it's been more than eight weeks since I filed it?

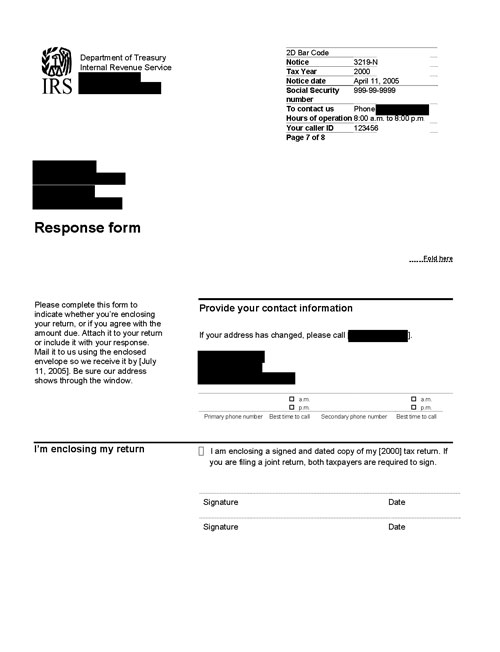

Complete the Response form from your notice. Check the name, Social Security number (or Taxpayer Identification Number), and tax year on your notice. Make sure they match the name, number, and year on the return. Mail us a copy of the tax return. Sign the return and date it; if filing a joint return your spouse must also sign the return. Send the return with the Response form to the address listed on the notice.

What happens if I can't pay the full amount I owe when I file my return?

You can make a payment plan with us when you can't pay the full amount you owe. If you owe tax on any return(s) you file, we will use your refund to help pay it.

Tips for next year

File your return on time.

Consider filing your taxes electronically. Filing online can help you avoid mistakes and find credits and deductions that you may qualify for. In many cases you can file for free. Learn more about e-file.

Understanding your notice

Your notice may look different from the sample because the information contained in your notice is tailored to your situation.

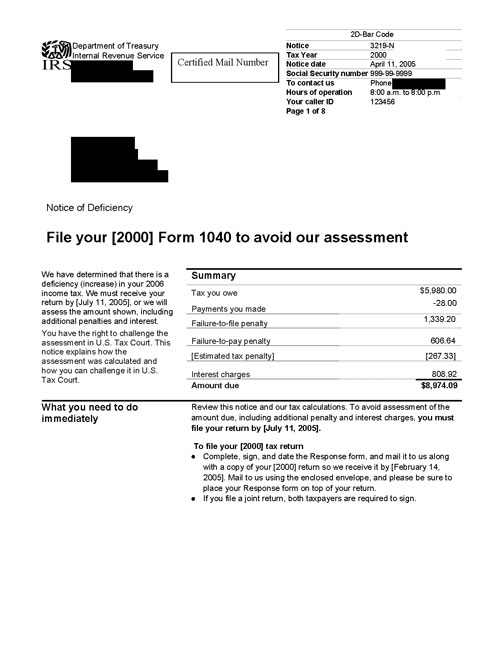

Notice CP3219N, Page 1

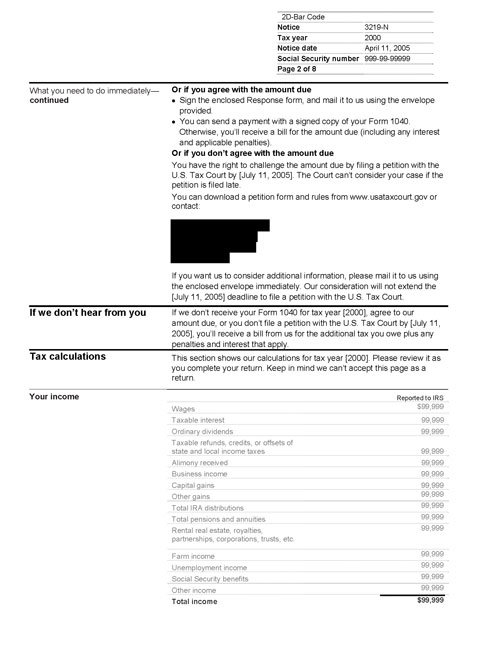

Notice CP3219N, Page 2

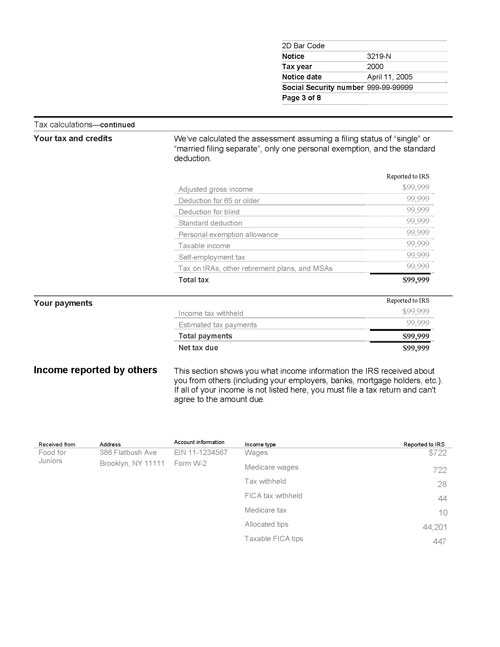

Notice CP3219N, Page 3

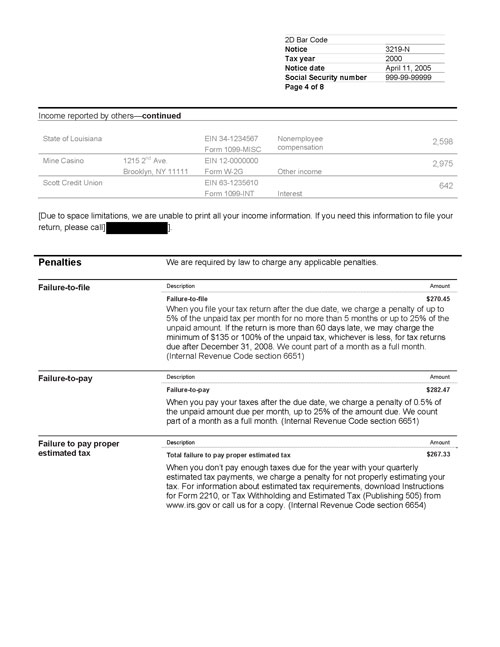

Notice CP3219N, Page 4

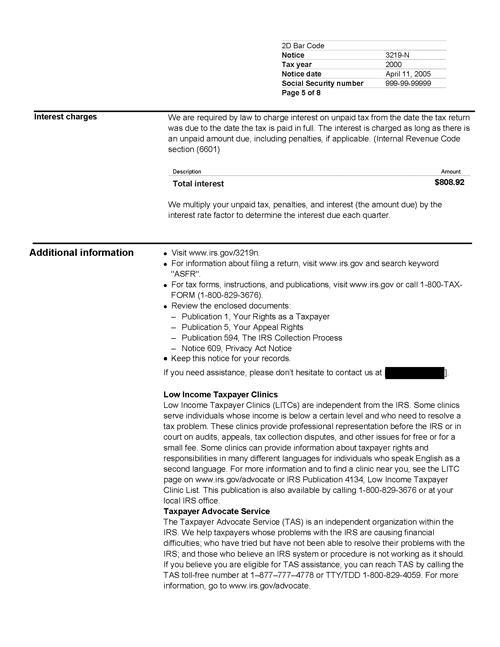

Notice CP3219N, Page 5

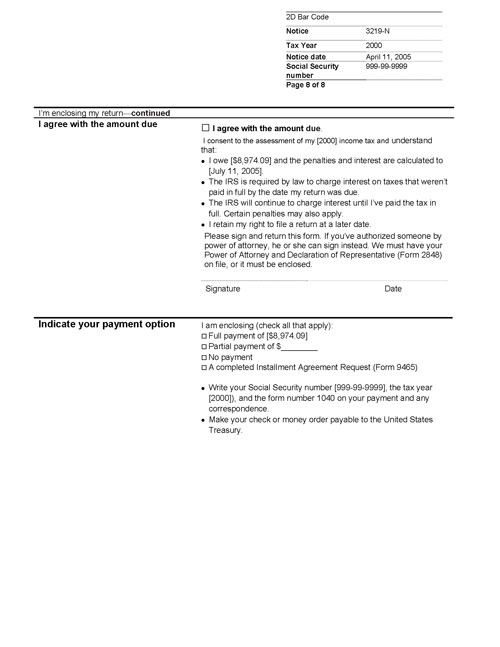

Notice CP3219N, Page 6

Notice CP3219N, Page 7

Notice CP3219N, Page 8