Understanding your CP10A Notice

We made a change(s) to your return because we believe there's a miscalculation involving your Earned Income Credit. This change(s) affected the estimated tax payment you wanted applied to your taxes for next year.

Tax publications you may find useful

- Publication 3498-A, The Examination Process

- Publication 596, Earned Income Credit (EIC)

- Form 1040-ES, Estimated Tax for Individuals

- Form 1040 (Schedule 8812) Child Tax Credit

- Publication 505, Tax Withholding and Estimated Tax

- Publication 972, Child Tax Credit

- Find a copy of any necessary tax forms and instructions

How to get help

Calling the toll free number listed on the top right corner of your notice is the fastest way to get your questions answered.

You can also authorize someone (such as an accountant) to contact the IRS on your behalf using this Power of Attorney and Declaration of Representative (Form 2848).

Or you may qualify for help from a Low Income Taxpayer Clinic.

What you need to do

- Read your notice carefully ― it will explain why we were unable to apply the amount you requested to next year’s taxes. It also will suggest additional steps for you to take, depending on your situation.

- Correct the copy of your tax return that you kept for your records.

- Adjust this year's estimated tax payments to avoid a possible underpayment of next year's taxes.

You may want to...

- Download copies of the following materials (if they weren't included with your notice):

- Call 1-800-829-FORM to have forms and publications mailed to you.

- Review the rules for claiming an Earned Income Credit.

- Complete and send us a Form 2848, Power of Attorney and Declaration of Representative to authorize someone (such as an accountant) to contact us on your behalf.

Answers to Common Questions

How do I adjust my estimated tax payments?

You can adjust your estimated tax payments with a Form 1040-ES, Estimated Tax for Individuals. For more information, see Publication 505, Tax Withholding and Estimated Tax.

How can I find out what caused my tax return to change?

Please contact us at the number listed on your notice for specific information concerning your tax return.

What should I do if I disagree with the changes you made?

If you disagree, contact us at the toll free number listed on the top right corner of your notice.

If you contact us in writing within 60 days of the date of this notice, we'll reverse the change we made to your account. However, if you're unable to provide us additional information that justifies the reversal and we believe the reversal is in error, we'll forward your case for audit. This step gives you formal appeal rights, including the right to appeal our decision in court before you have to pay the additional tax. After we forward your case, the audit staff will contact you within five to six weeks to fully explain the audit process and your rights. If you don’t contact us within the 60-day period, you'll lose your right to appeal our decision before payment of tax.

If you don't contact us within 60 days, the change won’t be reversed and you must pay the additional tax. You may then file a claim for refund. You must submit the claim within three years of the date you filed the tax return, or within two years of the date of your last payment for this tax.

What's the difference between the "Child Tax Credit" and the "Additional Child Tax Credit?" Can I qualify for both?

The Child Tax Credit is for people who have a qualifying child. The maximum amount you can claim is $1000 for each qualifying child. The Additional Child Tax Credit is for individuals who receive less than the full amount of Child Tax Credit. You may qualify for both the Child Tax Credit and the Additional Child Tax Credit.

How do I claim an Additional Child Tax Credit?

You claim the credit by completing a Form 1040 Schedule 8812, Child Tax Credit and attaching it to your income tax return.

My child is turning 18 this year. Can I still get the Additional Child Tax Credit?

No. Your child must be under age 17 at the end of 2009 to qualify for both the Child Tax Credit and the Additional Child Tax Credit.

Tips for next year

Consider filing your taxes electronically. Filing online can help you avoid mistakes and find credits and deductions that you may qualify for. In many cases you can file for free. Learn more about e-file.

If you have any dependent children, remember to claim the Additional Child Tax Credit the next time you file your income tax return. Complete and attach a Form 1040 Schedule 8812, Child Tax Credit to your return to claim this credit.

Use the EITC Assistant to help you complete your Schedule EIC, Earned Income Credit and claim your Earned Income Credit.

Understanding your notice

Reading your notice

Your notice may look different from the sample because the information contained in your notice is tailored to your situation.

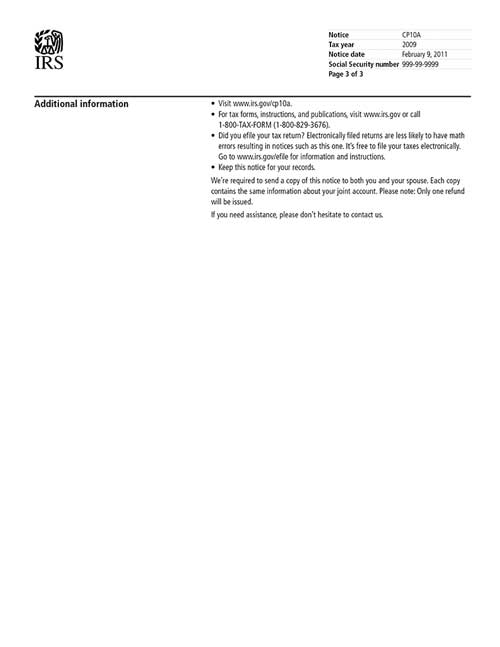

Notice CP10A, Page 1

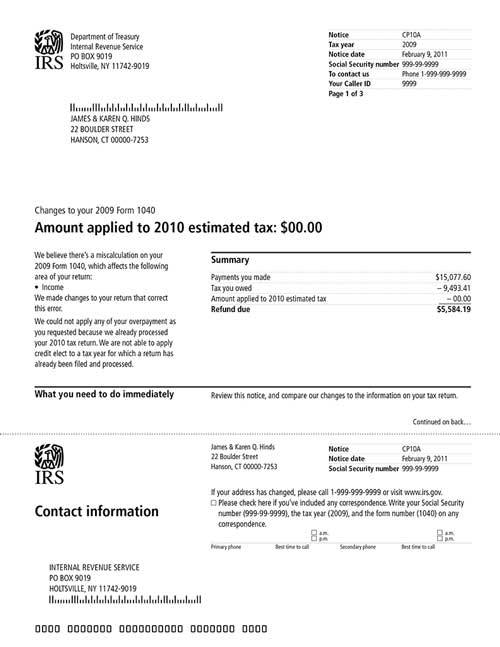

Notice CP10A, Page 2

Notice CP10A, Page 3