Understanding your CP13R Notice

We made changes to your return involving the Recovery Rebate Credit. You're not due a refund nor do you owe an additional amount because of our changes. Your account balance is zero.

Printable samples of this notice (PDF)

Tax publications you may find useful

- Publication 919, How Do I Adjust My Tax Withholding?

- Find a copy of any necessary tax forms and instructions

How to get help

Calling the 1-800 number listed on the top right corner of your notice is the fastest way to get your questions answered.

You can also authorize someone (such as an accountant) to contact the IRS on your behalf using this Power of Attorney and Declaration of Representative (Form 2848).

Or you may qualify for help from a Low Income Taxpayer Clinic.

What you need to do

- Read your notice carefully — it will explain how the Recovery Rebate Credit relates to the changes we made.

- Review the notice and compare our changes to the information on your tax return.

- Correct the copy of your tax return that you kept for your records.

- You don't need to do anything if you agree with the notice.

- If you disagree with the notice, please contact us at the toll-free number listed on its top right corner (within 60 days of its date).

You may want to...

- Download copies of the following materials (if they weren't included with your notice):

- Learn more about the Recovery Rebate Credit.

- Call 1-800-TAX-FORM (1-800-829-3676) to have forms and publications mailed to you.

- Complete and send us a Form 2848, Power of Attorney and Declaration of Representative to authorize someone (such as an accountant) to contact us on your behalf.

Answers to Common Questions

What is the Recovery Rebate Credit?

It is a refundable credit that relates to the 2008 economic stimulus payment. Generally, a refundable credit increases the amount of a refund received or it reduces the amount of taxes owed.

What should I do if I disagree with the changes you made?

Contact us at the toll free number listed on the top right corner of your notice if you disagree with the changes we made.

What should I do if I need to make another correction to my tax return?

You'll need to file an amended return to make a correction.

Tips for next year

Consider filing your taxes electronically. Filing online can help you avoid mistakes and find credits and deductions that you may qualify for. In many cases you can file for free. Learn more about e-file.

Perform a quick check on the amount you have withheld to make sure you won't owe money next year. You can use this IRS withholding calculator.

Understanding your notice

Reading your notice

Your notice may look different from the sample because the information contained in your notice is tailored to your situation.

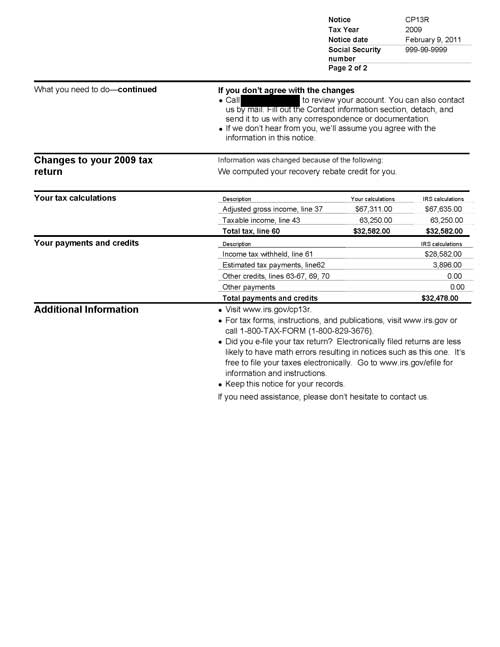

Notice CP13R, Page 1

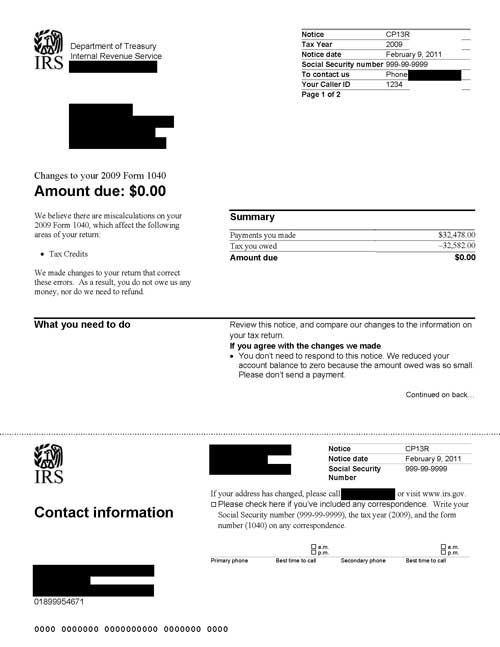

Notice CP13R, Page 2