Understanding your CP21B Notice

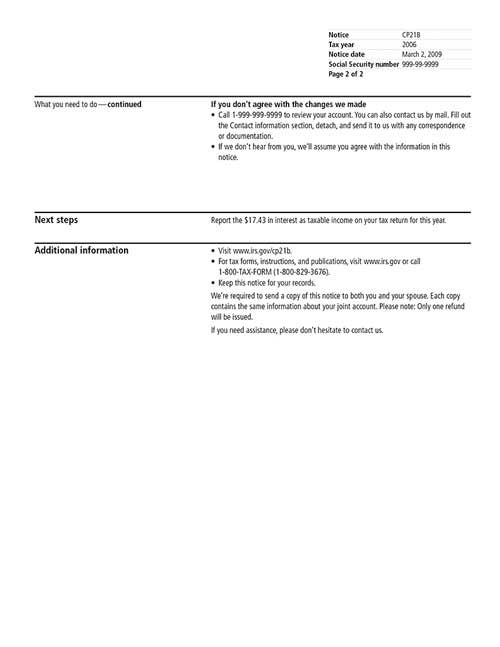

We made the change(s) you requested to your tax return for the tax year specified on the notice. You should receive your refund within 2-3 weeks of your notice.

Printable samples of this notice (PDF)

Tax publications you may find useful

How to get help

Calling the toll free number listed on the top right corner of your notice is the fastest way to get your questions answered.

You can also authorize someone (such as an accountant) to contact the IRS on your behalf using this Power of Attorney and Declaration of Representative (Form 2848).

Or you may qualify for help from a Low Income Taxpayer Clinic.

What you need to do

- Read your notice carefully ― it shows the area(s) of your tax return that changed, e.g., Schedule A.

- If you agree with the notice, you don't need to do anything.

- Contact us if you disagree with the change(s) we made.

- Correct the copy of your tax return that you kept for your records.

- Be sure to report any interest we paid you on your tax return for this year.

You may want to...

- Download additional information pertaining to your change.

Answers to Common Questions

What if I don't receive my refund in 2-3 weeks?

If you don't owe other taxes or debts we're required to collect, such as child support, and 3 weeks have lapsed, call us at the toll-free number listed on the top right corner of your notice.

Will I receive information about the interest that I need to report on my next tax return?

If you were paid $10 or more in interest, you'll receive a Form 1099-INT from IRS by January 31st of next year. Please note, even if the interest amount paid to you is less than $10, you must report this amount on your tax return.

The notice says "We made the changes you requested to your 2006 Form 1040 to adjust your..." but I don't remember sending any change to IRS. How can I find out what IRS received to initiate this change?

Please contact us at the number listed on the top right corner of your notice for specific information about your tax return.

What if I need to make another correction to my account?

You'll need to file Form 1040X, Amended U.S. Individual Income Tax Return.

What if I have tried to get answers and after contacting IRS several times have not been successful?

Call Taxpayer Advocate at 1-877-777-4778 or for TTY/TDD 1-800-829-4059.

What if I think I’m a victim of identity theft?

Please contact us at the number listed on the top right corner of your notice. Refer to the IRS Identity Theft resource page for more information.

Tips for next year

Consider filing your taxes electronically. Filing online can help you avoid mistakes and find credits and deductions that you may qualify for. In many cases you can file for free. Learn more about e-file.

Understanding your notice

Reading your notice

Your notice may look different from the sample because the information contained in your notice is tailored to your situation.

Notice CP21B, Page 1

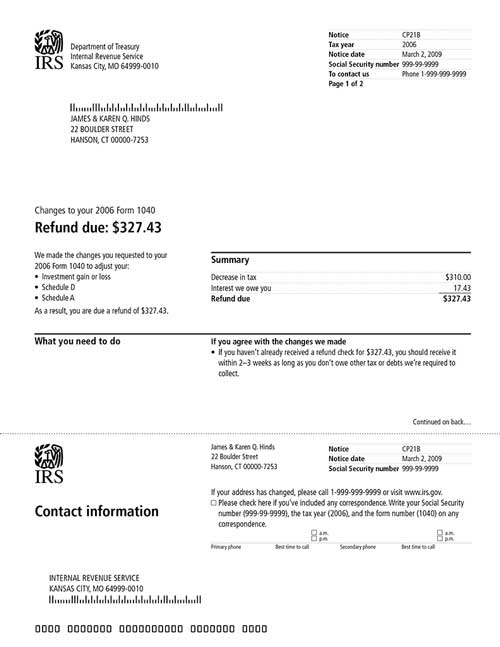

Notice CP21B, Page 2