Understanding your CP23 Notice

We made changes to your return because we found a difference between the amount of estimated tax payments on your tax return and the amount we posted to your account. You have a balance due because of these changes.

Printable samples of this notice (PDF)

Tax publications you may find useful

- Publication 1, Your Rights as a Taxpayer

- Notice 746, Information About Your Notice, Penalty and Interest

- Form 1040-ES, Estimated Tax for Individuals

- Publication 505, Tax Withholding and Estimated Tax

- Publication 594, The IRS Collection Process

- Form 9465, Installment Agreement Request

- Form 656-B, Offer in Compromise Booklet

- Find a copy of any necessary tax forms and instructions

How to get help

Calling the 1-800 number listed on the top right corner of your notice is the fastest way to get your questions answered.

You can also authorize someone (such as an accountant) to contact the IRS on your behalf using this Power of Attorney and Declaration of Representative (Form 2848).

Or you may qualify for help from a Low Income Taxpayer Clinic.

What you need to do

- Read your notice carefully — it will explain how much money you owe on your taxes.

- Check the list of payments we applied to your account to see if we applied all the payments you made.

- Correct the copy of your tax return that you kept for your records.

- Pay the amount you owe by the date on the notice's payment coupon if you agree with the notice.

- If you disagree with the notice, please contact us at the toll-free number listed on its top right-hand corner (within 60 days of the notice’s date).

- Make payment arrangements if you can't pay the full amount you owe.

You may want to...

- Download copies of the following materials (if they weren't included with your notice):

- Publication 1, Your Rights as a Taxpayer

- Notice 746, Information About Your Notice, Penalty and Interest

- Publication 505, Tax Withholding and Estimated Tax

- Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts and Instructions

- Form 1040-ES, Estimated Tax for Individuals

- Publication 594, The IRS Collection Process

- Form 9465, Installment Agreement Request

- Call 1-800-TAX-FORM (1-800-829-3676) to have forms and publications mailed to you.

- Complete and send us a Form 2848, Power of Attorney and Declaration of Representative to authorize someone (such as an accountant) to contact us on your behalf.

- Make payment arrangements if you cannot pay the full amount you owe.

- Learn more about your payment options and how to make a payment arrangement.

- Learn more about how to submit an Offer in Compromise.

- Review this year’s estimated tax payments to avoid an underpayment when you file your taxes next year.

Answers to Common Questions

What should I do if I find you misapplied a payment or haven't credited a payment that I made?

Contact us with your information at the toll-free number listed on your notice. Please have your documentation (such as cancelled checks, amended return, etc.) ready when you call. Our representative will discuss the issue with you and give you further instructions.

What should I do if I disagree with the changes you made?

Contact us at the toll free number listed on the top right-hand corner of your notice.

How do I adjust my estimated tax payments?

You can adjust your estimated tax payments by completing a Form 1040-ES, Estimated Tax for Individuals. See Publication 505, Tax Withholding and Estimated Tax for more information.

What should I do if I need to make another correction to my tax return?

You'll need to file Form 1040X, Amended U.S. Individual Income Tax Return.

Do I have to pay interest on the amount I owe?

Interest will accrue on the amount you owe unless you pay it by the requested date on the notice's payment coupon.

Do I receive a penalty if I cannot pay the full amount?

Yes. You usually will receive a late payment penalty. Notice 746, Information About Your Notice, Penalty and Interest has more information about penalties and interest.

What happens if I cannot pay the full amount I owe?

You can arrange to make a payment plan with us if you can't pay the full amount you owe.

How can I set up a payment plan?

Call the toll-free number listed on the top right-hand corner of your notice to discuss payment options, or learn more about payment arrangements.

What happens if I don't pay?

We can file a Notice of Federal Tax Lien. The lien gives us a legal claim to your property for payment for your tax debt.

Tips for next year

Consider filing your taxes electronically. Filing online can help you avoid mistakes and find credits and deductions that you may qualify for. In many cases you can file for free. Learn more about e-file.

Understanding your notice

Reading your notice

Your notice may look different from the sample because the information contained in your notice is tailored to your situation.

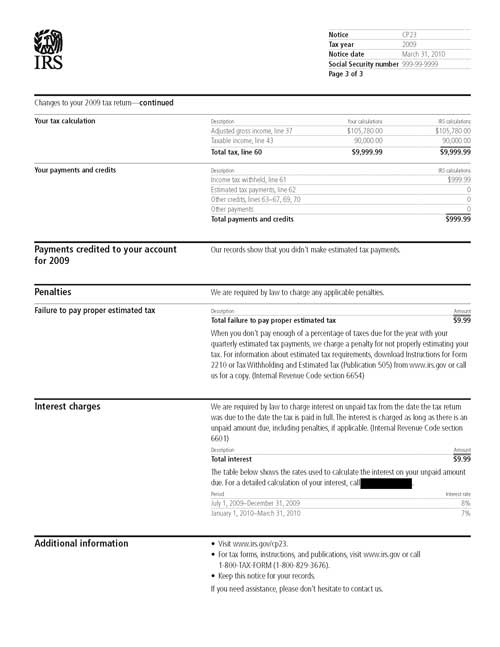

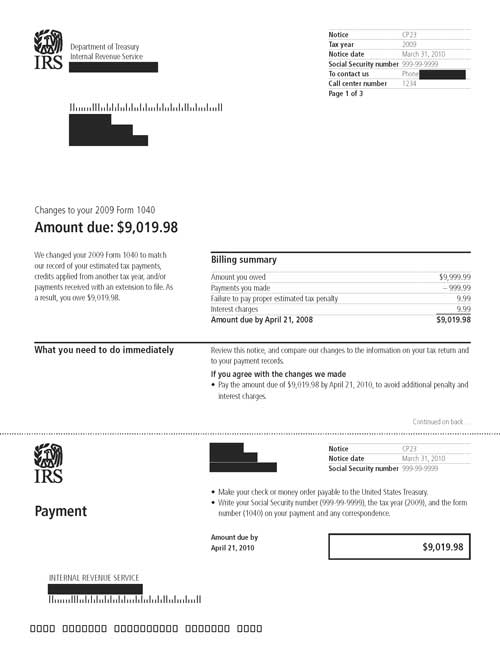

Notice CP23, Page 1

Notice CP23, Page 2

Notice CP23, Page 3