Understanding your CP259 Notice

We've sent you this notice because our records indicate you didn't file the required business tax return identified in the notice.

Printable samples of this notice (PDF)

Tax publications you may find useful

- Publication 15, (Circular E), Employer’s Tax Guide

- Publication 505, Tax Withholding and Estimated Tax

- Publication 334, Tax Guide for Small Business

- Publication 541, Partnerships

- Publication 542, Corporations

- Various Tax Publications for Business

- Find a copy of any necessary tax forms and instructions

How to get help

Calling the 1-800 number listed on the top right corner of your notice is the fastest way to get your questions answered.

You can also authorize someone (such as an accountant) to contact the IRS on your behalf using this Power of Attorney and Declaration of Representative (Form 2848).

What you need to do

- File your required business return immediately.

- If eligible, file your return electronically with all required schedules, using your e-file provider, or

- File a paper return with all required schedules

- Complete the Response form enclosed with your notice and mail it to us, using the enclosed envelope:

- To explain why you are filing late.

- To explain why you don’t think you need to file.

- If you have already filed and it's been more than four weeks, or if you used a different name or Employer ID number (EIN) than shown on the notice when filing.

- If you have filed within the last four weeks using the same name and EIN shown on the notice, you may disregard this notice.

You may want to...

- Review Tax Information for Businesses which provides information regarding various business filing issues.

- Review your records and ensure all returns are filed timely.

Answers to Common Questions

Why did I receive multiple CP 259 notices?

If your business hasn't filed tax returns, a notice will be generated and mailed for each tax form and tax period the IRS shows as delinquent.

I have never had employees and or filed this return previously so why did I receive a notice requesting me to file?

When you apply for an Employer Identification number, filing requirements are established requiring specific types of returns to be filed (e.g. Form 940, Employer's Annual Federal Unemployment Tax Return; Form 941, Employer's Quarterly Federal Tax Return; Form 1120, U.S. Corporation Income Tax Return, etc.). When the return is not filed, the IRS considers it to be delinquent and generates a notice requesting the return be filed.

Do I still need to file a tax return even if I had no employees or business activity during the tax period(s) in question?

If you had no employees or business activity during a tax period you are not required to file a return for that tax period. You still need to respond to this notice. If you made Federal Tax Deposits or other payments or credits for the tax period, you must file a signed return showing the payments to get a refund.

Tips for next year

File all required returns by the appropriate due date.

Understanding your notice

Reading your notice

Your notice may look different from the sample because the information contained in your notice is tailored to your situation.

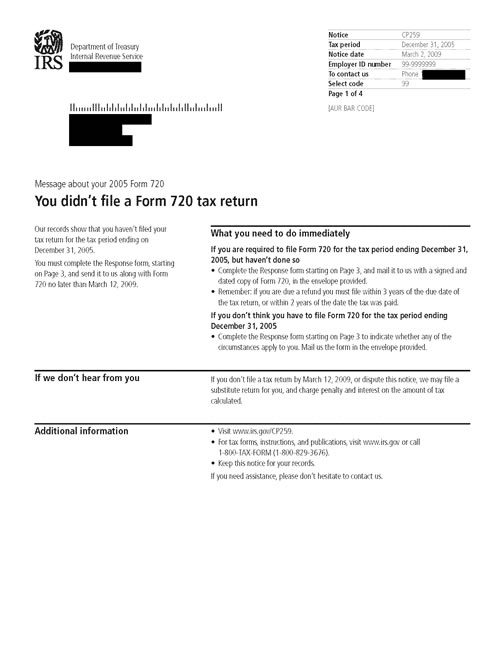

Notice CP259, Page 1

Notice CP259, Page 2

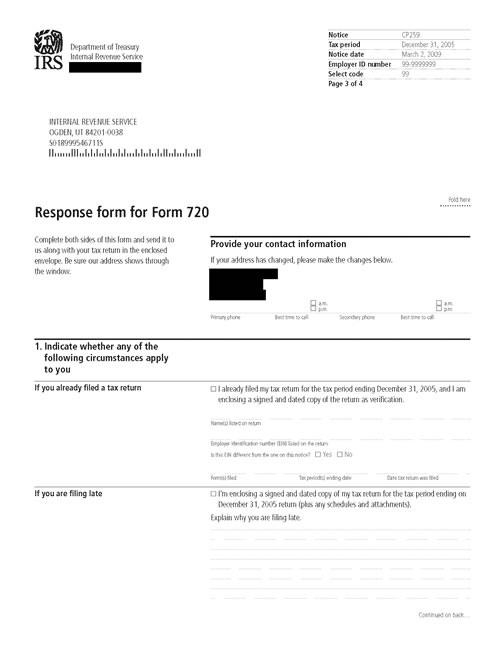

Notice CP259, Page 3

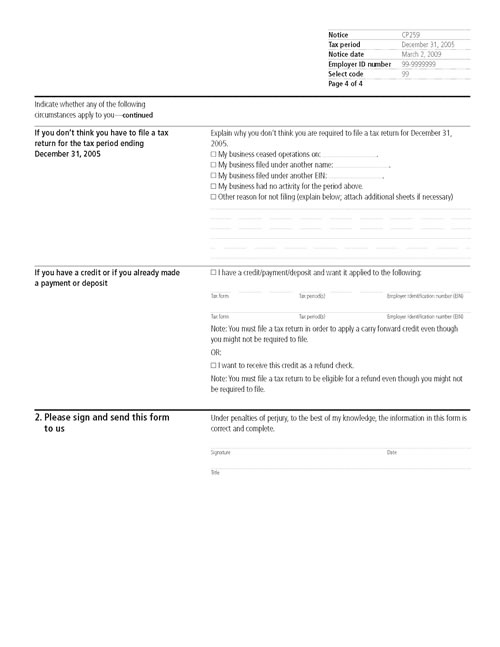

Notice CP259, Page 4