Understanding your CP51B Notice

We computed the tax on your Form 1040, 1040A or 1040EZ. You owe taxes.

What you need to do

- Read your notice carefully. It will explain how we calculated refund.

- You don't need to do anything if you agree with our calculations.

- Contact us if you disagree with the amount of tax we computed.

You may want to...

- Download copies of the following materials (if they were not included with your notice):

- Call 1-800-TAX-FORM (1-800-829-3676) to order forms and publications.

- Complete and send us a Form 2848, Power of Attorney and Declaration of Representative to authorize someone (such as an accountant) to contact us on your behalf.

Answers to Common Questions

What should I do if I disagree with the notice?

Call us at the toll free number on the top right corner of your notice. Please have your paperwork (such as cancelled checks, amended return, etc.) ready when you call.

When will I receive my refund?

If you have not already received your refund and if you owe no other taxes or other debts we are required to collect, you should receive it within 2-3 weeks.

Tips for next year

Consider filing your taxes electronically. Filing online can help you avoid mistakes and find credits and deductions that you may qualify for. In many cases you can file for free. Learn more about e-file.

Understanding your notice

Reading your notice

Your notice may look different from the sample because the information contained in your notice is tailored to your situation.

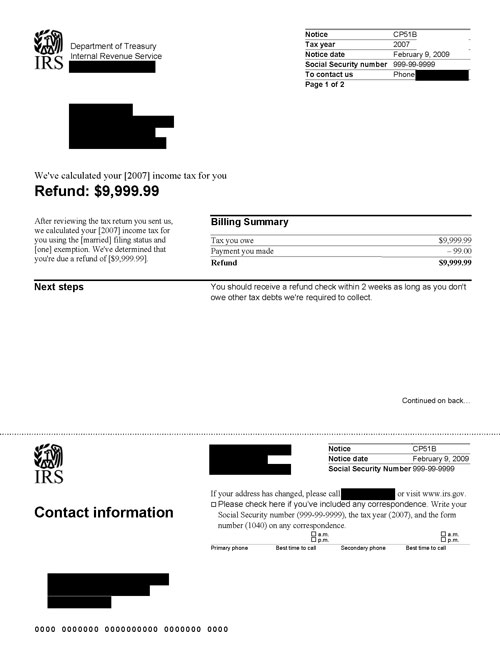

Notice CP51B, Page 1

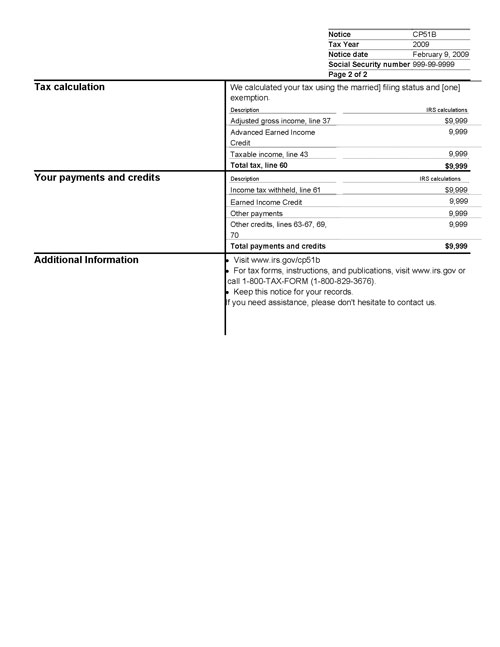

Notice CP51B, Page 2