You are hereHome > Blogs

Blogs

Much Higher Surety Bond Guarantee Ceilings

|

Created on February 8, 2013 |

Enable Small Businesses to Bid on Larger Contracts and Grow

A major revision in the U.S. Small Business Administration’s Surety Bond Guarantee (SBG) Program more than triples the eligible contract amount, from $2 million to $6.5 million, the Agency will guarantee on surety bonds for both public and private contracts.

A major revision in the U.S. Small Business Administration’s Surety Bond Guarantee (SBG) Program more than triples the eligible contract amount, from $2 million to $6.5 million, the Agency will guarantee on surety bonds for both public and private contracts.

What does this mean for small businesses trying to grow?

A Los Angeles subcontractor for example, was looking to take on bigger jobs and grow its business, but needed a much larger bond to bid on and get a contract that was larger than past work it had performed.

As a direct result of higher SBA guaranteed bond limits, companies like that California contractor can now experience continued growth in bonding capacity, employ more employees and improve revenue streams. And with that kind of growth and resulting experience on bigger jobs, such companies can bid on more federal construction contracts, build an even stronger management team, and set strategic plans for bigger contracts and expansion into larger markets.

MBDA Business Center Spotlight: Puerto Rico

While most of the work the MBDA Business Center in San Juan, Puerto Rico does is conducted in Spanish, that is where the differences between it and the 40 other MBDA Business Centers across the country end. Just like the other MBDA Business Centers throughout the nation, the Puerto Rico MBDA Business Center works diligently to secure contracts for its clients and build wealth for its community. It also guides clients in putting together business strategies that will attract financing.

One recent example that stands out involved a business owner looking to open a jewelry store in the island’s biggest shopping mall. Confident that the endeavor would be a huge success, after being turned away by bank after bank, the owner contacted the MBDA Business Center.

Congress Returns, President Signs Bill for Sandy Flood Insurance

|

Created on January 29, 2013 |

On Thursday, January 3rd, 2013, the 113th Congress was sworn in and began the new legislative session. One of its first acts came on Friday, January 4th, when the House and Senate passed a bill providing $9.7 billion in aid for victims of Superstorm Sandy. Signed by President Obama on January 6, the aid comes in the form of increased borrowing authority for the National Flood Insurance Program (NFIP) so that it remains able to meet its obligations and compensate survivors of the natural disaster.

Have you looked at your firm’s export attributes?

| Created on January 29, 2013 |

Thinking bigger, thinking broader, and working smarter is commonplace for business owners. The same holds true for MBDA in promoting the growth and global competitiveness of America’s fastest growing companies, the minority business community. As we look ahead, we are encouraged that the Build it Here, Sell it Everywhere vision of the U.S. Department of Commerce continues to resonate and gain momentum throughout the business community.

The value of tapping into international markets cannot be overstated. Boosting exports is critical to stimulating our country’s economic growth and job creation. This is an area in which minority-owned businesses play a leadership role. Shared languages, cultural affinities, and a global reach that spans 41 countries on six continents make minority-owned firms natural exporters. MBDA is uniquely positioned to engage the Diaspora communities across the country and help leverage their cultural and ancestral ties to key foreign markets and create greater access for U.S. products and services.

Minority Entrepreneurs — Continuous Success with Angel Investors!

|

Created on January 23, 2013 |

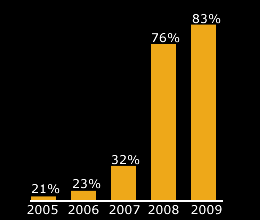

Minority-owned businesses are the fastest growing business sector in the Nation, in terms of gross receipts and paid employees.[1] Yet, access to capital remains the biggest obstacle limiting their establishment, expansion and growth. While traditional funding remains the most sought after source of capital, alternative funding sources, such as angel investors, have proven successful for minority entrepreneurs.

Minority-owned businesses are the fastest growing business sector in the Nation, in terms of gross receipts and paid employees.[1] Yet, access to capital remains the biggest obstacle limiting their establishment, expansion and growth. While traditional funding remains the most sought after source of capital, alternative funding sources, such as angel investors, have proven successful for minority entrepreneurs.

Minorities represent on average less than 7% of all entrepreneurs seeking funding from angel investors. However, they succeed in acquiring angel funding as often as their non-minority counterparts. From January 2009 to June 2012, 17% of all entrepreneurs seeking angel investor funding succeeded. The yield rate for minority entrepreneurs during that same period was 16.1%, a negligible difference. The yield rate is the percentage of investment opportunities that are brought to the attention of investors that result in an investment.