FAQs are designed to assist businesses in answering the most common questions about the SmartPay program.

- About GSA SmartPay

- Program Coordinators

- Cardholders

- Businesses & Vendors

- News & Events

- Contact Information

- GSA SmartPay Savings Calculator

- About GSA SmartPay

- Program Coordinators

- Cardholders

- Businesses & Vendors

- News & Events

- Contact Information

- GSA SmartPay Savings Calculator

How do I accept GSA SmartPay Cards?

Businesses and vendors - Maximize your ability to capture government sales by accepting GSA SmartPay charge cards.

General FAQs

- How does the GSA SmartPay Program work?

- Who qualifies for a Government charge card?

- Why does the Government have a charge card program?

- What types of charge cards does the Government use?

- What are the benefits of charge card use by the Government?

- Which banks provide charge cards to the Government?

- How much money is spent using Government charge cards each year?

- What alternatives are available instead of charge cards?

How does the GSA SmartPay Program work?

The GSA SmartPay Program manages a set of master contracts through which agencies and organizations can obtain charge cards for employees to accomplish the agency or organization’s mission. Agencies can obtain a number of different types of charge card products and services, including purchase, travel, fleet, and integrated cards.

Agencies and organizations issue a task order under the GSA SmartPay 2 master contracts, and award their program to one of the GSA SmartPay 2 contractor banks (Citibank, JPMorgan Chase, or U.S. Bank). The banks provide charge cards to the agency or organization employees to make purchases on behalf of the agency/organization.

Who qualifies for a Government charge card?

Eligibility for the program is determined by the GSA SmartPay Contracting Officer. Federal agencies, departments, tribal organizations, and approved non-federal entities can apply to obtain charge card services under the GSA SmartPay program.

Why does the Government have a charge card program?

Charge cards enable authorized Government employees to make purchases on behalf of the Government to support their agency or organization’s mission, mostly for small (generally under $3,000) work-related purchases, travel expenses, and fuel. In many cases, traditional paper-based processing techniques cost the Government more to process the transaction than the transaction itself. Charge cards:

- Streamline transaction processing;

- Increase accountability;

- Provide agencies with a more efficient and effective means to monitor large numbers of transactions and identify fraud, waste, and abuse.

Prior to using charge cards, the Government used traditional paper-based payment processes such as purchase orders for small purchases. The inefficiency, costs, and/or risks associated with these processes were a key factor in the dramatic increase in the use of charge cards.

What types of charge cards does the Government use?

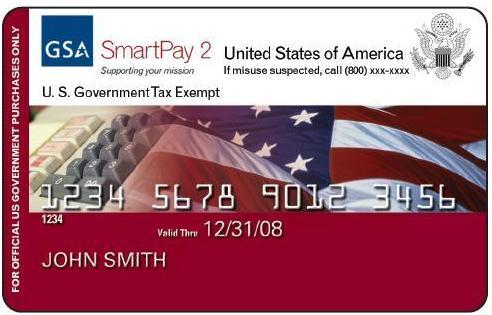

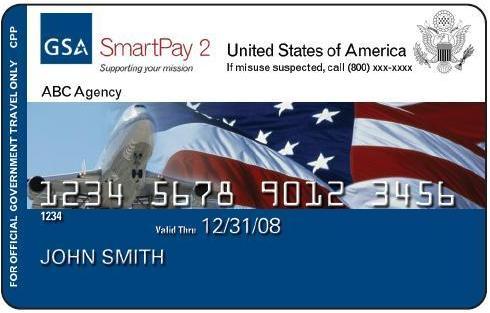

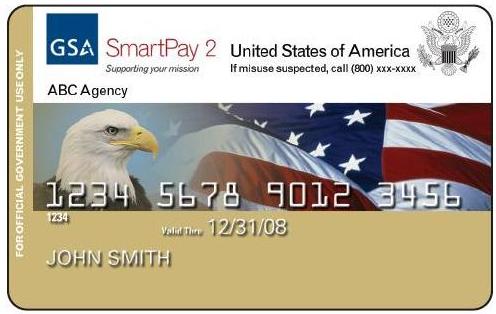

There are four primary card types offered through the GSA SmartPay program. Each card type has a specific purpose, and is used by cardholders to make different types of purchases. These card types include purchase, travel, fleet, and integrated cards.

|

|

|

|

Purchase cards are used to make general purchases for supplies and services. All purchase cards are centrally billed to the Government, and paid for by the Government.

Travel cards are used specifically to pay for travel related expenses for Government employees on official Government travel. Travel cards come in two types, centrally billed accounts (CBA) and individually billed accounts (IBA).

- CBA cards tend to be used to manage the travel plans for a group of people or an office. These are billed to and paid by the Government.

- IBA cards are issued to individual Government travelers, and are billed to and paid by the Government traveler. Generally the Government traveler has to file a travel voucher with their agency to get reimbursed for their travel expenses.

Fleet cards are used to manage vehicles for Government agencies, specifically for fuel and minor repairs. All fleet cards are CBAs.

Integrated cards are cards that are used for more than one type of purchase. For example, a person may have an integrated card that allows them to make office supply purchases and to charge travel expenses.

What are the benefits of charge card use by the Government?

There are a number of benefits associated with the use of charge cards by the Government:

- Administrative cost savings – The estimated administrative savings for the purchase card alone is $1.7 billion per year ($70 per transaction) when used in place of a written purchase order. No studies have been done to estimate the transactional savings of the other programs.

- Identification for discount programs – The GSA SmartPay travel card is required to obtain airfare discounts through the GSA City Pairs program, creating an estimated $3.6 billion in annual savings Governmentwide.

- Agency refunds – Charge cards generate performance-based refunds for agencies.

- Others – Charge cards provide other less tangible benefits, including detailed transaction data, improved ability to monitor transactions, travel insurance, and eliminate the need for imprest funds or petty cash at the agency.

Which banks provide charge cards to the Government?

Three banks provide charge cards under the current GSA SmartPay2 contract: Citibank, JPMorgan Chase, and US Bank. The current contracts provide service from 2007 through 2018.

How much money is spent using Government charge cards each year?

For more detail on the performance of the GSA SmartPay program, please see the Program Statistics page.

What alternatives are available instead of charge cards?

Other options include debit cards, prepaid cards, or alternative payment platforms(e.g., electronic fund transfers linked to a payment tracking system). Agencies have the option to obtain these tools through the GSA SmartPay2 master contract.

| Previous | Next |

The GSA SmartPay® program provides charge cards to agencies/departments throughout the U.S. government, as well as tribal governments, through master contracts that are negotiated with major national banks.

SmartPay® Charge Cards are for Official U.S. Government usage only.

![]()

- About GSA SmartPay

- Program Coordinators

- Cardholders

- Businesses & Vendors

- News & Events

- Contact Information

- GSA SmartPay Savings Calculator

This is an official U.S. Government Web site managed by the GSA.