We help consumers with complaints about credit cards, mortgages, student loans, checking accounts, savings accounts, credit reporting, bank services, and other consumer loans. Today, we’re announcing plans to share data from those complaints with state regulatory agencies.

This way, multiple government agencies can work on the consumer’s behalf without them having to file complaints with multiple agencies at different levels of government.

By providing real-time access to our growing database of consumer complaints, state government agencies will have a more complete picture of the markets for consumer financial product or services and be able to help more consumers in their state.

We’ll start by sharing our consumer complaints via a secure channel that protects the confidentiality of personally identifiable information. In the future, we’re planning on building ways to accept complaints and information from the agencies as well, and to make the data available to other federal agencies, state attorneys general, local agencies, congressional offices as appropriate, and other governmental organizations like the California Monitor (a program of the California Attorney General) and the Office of Mortgage Settlement Oversight.

What happens when I file a complaint?

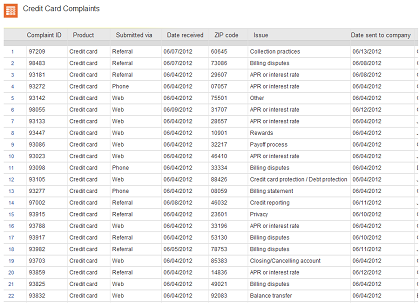

When a consumer files a complaint, we screen it to make sure that it’s complete and not a duplicate of another complaint we’re already working on for that consumer. Next, we send it to the company in question and ask them to reply to the complaint within 15 days and expect them to close all but the most complicated complaints within 60 days. After the company responds, we publish a selection of the data (with information identifying the consumer removed) in our public Complaint Database.

The team that works on consumer complaints also works closely with other parts of the Bureau including our Division of Supervision, Enforcement, and Fair Lending and Equal Opportunity to address any potential violations of consumer law.

Our goal in sharing consumer complaints with state agencies is to enhance efficient, transparent, and effective government to better protect American consumers. This new capability is yet another example of the good government principles of cooperation and coordination in action. We look forward to continuing to deepen the already strong relationship we have with our partners.

Scott Pluta is the Assistant Director for the Office of Consumer Response at the Consumer Financial Protection Bureau.