Home.Common Floor Stocks Tax (FST) Errors

Common Floor Stocks Tax (FST) Errors

Floor stocks tax returns have begun arriving at TTB’s National Revenue Center (NRC). Our preliminary review of these tax returns suggests that some taxpayers are experiencing difficulty completing the returns properly. The following list of common errors will hopefully help you avoid the mistakes that we have seen so far.

If you still have questions, feel free to contact the NRC toll-free at 1-877-882-3277.

Error 1: Failing to take the tax credit

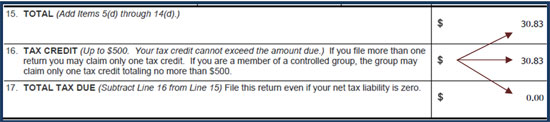

Each taxpayer is allowed a tax credit up to $500. If your total tax liability on line 15 of the tax return (TTB F 5000.28T09) is less than $500, enter a tax credit equal to that tax liability amount on line 16, and enter “0.00” as your total tax due on line 17 (see below).

Remember that if you are part of a controlled group, your group is only entitled to one $500 credit, which may be split among the controlled group’s members. If you are not taking a credit because the credit will be taken by someone else in your controlled group, enter “0.00” on line 16 of the tax return.

Error 2: Using the wrong units (quantities) in Column (b)

The tax form requires you to enter the following ‘units’ in column (b) of the tax return:

- Line 5: Total number of small cigarettes (NOT cartons, NOT packs, but individual cigarettes)

- Line 6: Total number of large cigarettes (NOT cartons, NOT packs, but individual cigarettes)

- Line 7: Total number of small cigars (NOT packages, but individual cigars)

- Line 9: Total pounds (rounded to 2 decimal places) of chewing tobacco (NOT tins, packages, cans, etc.)

- Line 10: Total pounds (rounded to 2 decimal places) of snuff (NOT tins, packages, cans, etc.)

- Line 11: Total pounds (rounded to 2 decimal places) of pipe tobacco (NOT cans, bags, pouches, etc.)

- Line 12: Total pounds (rounded to 2 decimal places) of roll-your-own tobacco (NOT bags, cans, pouches, drums, etc.)

- Line 13: Total units of 50 cigarette papers (after counting your units, if there is any partial amount less than 50 papers, it counts as a whole unit)

- Line 14: Total units of 50 cigarette tubes (after counting your units, if there is any partial amount less than 50 papers, it counts as a whole unit)

So, how do you perform the calculations necessary to determine the correct quantity for the tax return? Review the 3 sample scenarios below and follow the corresponding instructions for each type of product.

Scenario 1 - Small Cigarettes: Company A completes its inventory as of April 1, 2009. Company A has 15 cartons of Class A cigarettes in its inventory. Company A must convert the 15 cartons to individual cigarettes before transferring the total to the tax return.

Note: A standard carton contains 10 packs of cigarettes, each pack containing 20 cigarettes. Therefore, a standard carton of cigarettes contains 200 cigarettes (10 packs x 20 cigarettes = 200 cigarettes).

Step 1: Company A determines that it carries only standard cartons in its inventory, so the total number of cigarettes in Company A’s inventory is 3,000 (200 cigarettes x 15 cartons = 3,000 cigarettes).

Step 2: Company A enters “3,000” on line 5, column (b) of the tax return.

Step 3: Company A multiplies column (b) (3,000) by column (c) ($0.03083) and enters the result ($92.49) in column (d), line 5. (See below)

![]()

Scenario 2 – Pipe Tobacco: Company A also sells pipe tobacco. Company A has in its inventory 110 8-oz cans and 25 12-oz bags of pipe tobacco. Company A must determine the total number of pounds of pipe tobacco in its inventory and transfer that quantity to the tax return on line 11.

Note: There are 16 ounces in 1 pound.

Step 1: Company A must determine the total number of ounces contained in the packages and then convert the ounces to pounds, rounding to 2 decimal places.

Company A calculates the total number of ounces in all of the 8-oz cans (110 cans x 8 oz = 880 oz). Company A calculates the total number of ounces in all of the 12-oz bags (25 bags x 12 oz = 300 oz). Company A then adds the two quantities together to determine the total number of ounces of pipe tobacco in its inventory (880 oz + 300 oz = 1,180 oz).

Step 2: Company A must now convert the total ounces to pounds and round to 2 decimal places (1,180 oz ÷ 16 oz = 73.75 lb).

Step 3: Company A enters “73.75” on line 11, column (b) of the tax return.

Step 4: Company A multiplies column (b) (73.75) by column (c) ($1.7342) and enters the result ($127.90, rounded from $127.8973) in column (d), line 11. (See below)

![]()

Scenario 3 – Cigarette Papers: Company A also sells cigarette papers. Company A has in its inventory 305 packs, each containing 24 cigarette papers. Company A must determine the total number of taxable units (increments of 50 and portions thereof) of cigarette papers in its inventory and transfer that quantity to the tax return on line 13.

Step 1: Company A multiplies the number of packs by the quantity of papers in each pack (305 packs x 24 papers = 7,320 papers).

Step 2: Company A must now convert the total number of papers into taxable units of 50. (7,320 papers ÷ 50 papers = 146.4 units) Since any partial unit counts as a whole unit, the total number of taxable units in Company A’s inventory is 147.

Step 3: Company A enters “147” on line 13, column (b) of the tax return.

Step 4: Company A multiplies column (b) (147) by column (c) ($0.0193) and, enters the result ($2.84, rounded from $2.8371) in column (d), line 13. (See below)

![]()

Error 3: Mistaking small cigarettes for large cigarettes

Cigarettes that meet the tax classification of “large cigarettes” are not commonly found in the market. Some long Class A cigarettes (small cigarettes) may be mistaken for large cigarettes. Before assuming that certain cigarettes are large cigarettes, look for the markings on the package. If the package is marked “Class A” or “small cigarettes”, you may assume that the package contains small cigarettes. If the package is marked “Class B” or “large cigarettes”, you may assume that the package contains large cigarettes.

If the product is a large cigarette, you must measure the length of the cigarette. If the cigarette is more than 6.5 inches in length, you must divide the total length by 2.75. Each 2.75 inches, and fraction thereof, of the cigarette counts as a single small cigarette for tax purposes. For example, a large cigarette that is 7 inches in length will be the equivalent of 2.5 small cigarettes for tax purposes.

Error 4: Rounding the dollar amount due

When calculating the dollar amount due, you must round using the normal rules of rounding. It appears that some taxpayers are rounding down, or truncating (dropping all digits after 2 decimal places) the dollar amount due.

Example 1: Taxpayer has 1.65 pounds of chewing tobacco multiplied by the floor stocks tax rate of $0.3083 per pound. 1.65 x $0.3083 = $0.508695. The calculated tax (rounded up) is $0.51. Because the digit in the 3rd position after the decimal is greater than or equal to (>=) 5, the result of the equation must be rounded up.

Example 2: Taxpayer has 175 small cigarettes multiplied by the floor stocks tax rate of $30.83 per thousand. 175 x $0.03083 = $5.39525. The calculated tax (rounded up) is $5.40. Because the digit in the 3rd position after the decimal is greater than or equal to (>=) 5, the result of the equation must be rounded up.