Voluntary Fiduciary Correction Program Online Calculator

with Instructions, Examples and Manual Calculations

|

|||||||||

Overview

EBSA is providing this Voluntary Fiduciary Correction Program (VFCP) Online Calculator as a compliance assistance tool to facilitate accuracy, ensure consistency, and expedite review of applications. The Online Calculator assists applicants in calculating VFCP Correction Amounts owed to benefit plans. Use of the Online Calculator by applicants is recommended, but is not mandatory. Applicants may perform manual calculations in accordance with VFCP Section 5(b), using the IRC underpayment rates and the IRS Factors.

How The Online Calculator Works

The Online Calculator computes Lost Earnings and interest, if any. If the Principal Amount was used for a specific purpose such that a profit on the use of the Principal Amount is determinable, the Online Calculator also computes interest on the profit.

The Online Calculator then compares Lost Earnings to Restoration of Profits and provides the applicant with the greater amount, which must be paid to the plan.

The Online Calculator uses IRC Section 6621(a)(2) and (c)(1) underpayment rates in effect during the time period and the corresponding factors from IRS Revenue Procedure 95-17 (IRS Factors), which reflect daily compounding. Under the VFCP special rules for transactions involving large losses or large restorations, the Online Calculator automatically recomputes the amount of Lost Earnings and Restoration of Profits using the applicable IRC Section 6621(c)(1) rates.

Instructions

Correction of most eligible VFCP transactions involves repayment of a Principal Amount. Select the transaction you are correcting from the Index Of Eligible VFCP Transactions for examples of calculations. Consult these examples first to be certain you enter the correct Principal Amount in the Online Calculator for the type of transaction being corrected.

Generally, the instructions for using the Online Calculator are:

- Enter the Principal Amount. (Note: Not all VFCP transaction corrections involve a Principal Amount, and in those cases Lost Earnings would not be calculated.)

- Enter the Loss Date.

- Enter the Recovery Date.

- Enter the Final Payment Date. (i.e., date Lost Earnings and interest, if any, will be paid.) If Lost Earnings are paid on the Recovery Date, leave the Final Payment Date blank.

- The Online Calculator computes a total. This total reflects only Lost Earnings and interest, if any, but not any Principal Amount that also must be paid to the plan.

- Continue entering data as needed (e.g. for additional pay periods) until all information is entered.

- Select the Calculate Restoration of Profits button only if a profit is determinable.

- Applicants must print and submit with the application calculations and data necessary for the Department to verify the calculations. The Online Calculator allows applicants to view printable inputs and results. Note: Calculations and data cannot be saved online. You may save your results by printing a copy or copying/pasting a copy into a text document on your computer before terminating your session.

Index Of Eligible VFCP Transactions

Delinquent Remittance Of Participant Funds

- Delinquent Participant Contributions and Participant Loan Repayments to Pension Plans (See Example 1)

- Delinquent Participant Contributions to Insured Welfare Plans (No Lost Earnings)

- Delinquent Participant Contributions to Welfare Plan Trusts (See Example 1)

Loans

- Loan at Fair Market Interest Rate to a Party in Interest with Respect to the Plan (No Lost Earnings)

- Loan at Below-Market Interest Rate to a Party in Interest with Respect to the Plan (See Example 2)

- Loan at Below-Market Interest Rate to a Person Who is Not a Party in Interest with Respect to the Plan (See Example 2)

- Loan at Below-Market Interest Rate Solely Due to a Delay in Perfecting the Plan’s Security Interest (See Example 2)

Participant Loans

- Loans Failing to Comply with Plan Provisions for Amount, Duration or Level Amortization (No Lost Earnings)

- Default Loans (No Lost Earnings)

Purchases, Sales, And Exchanges

- Purchase of an Asset (Including Real Property) by a Plan from a Party in Interest (See Example 3)

- Sale of an Asset (Including Real Property) by a Plan to a Party in Interest (See Example 4)

- Sale and Leaseback of Real Property to Employer (See Example 3 for the Sale portion of the transaction; See Example 2 if the rent was below fair market value)

- Purchase of an Asset (Including Real Property) by a Plan from a Person Who is Not a Party in Interest with Respect to the Plan at a Price More Than Fair Market Value (See Example 3)

- Sale of an Asset (Including Real Property) by a Plan to a Person Who is Not a Party in Interest with Respect to the Plan at a Price Less Than Fair Market Value (See Example 4)

- Holding of an Illiquid Asset Previously Purchased by a Plan (See Example 3)

Benefits

- Payment of Benefits Without Properly Valuing Plan Assets on Which Payment is Based (See Example 5)

Plan Expenses

- Duplicative, Excessive, or Unnecessary Compensation Paid by a Plan (See Example 6)

- Expenses Improperly Paid by a Plan (See Example 6)

- Payment of Dual Compensation to a Plan Fiduciary (See Example 6)

Example 1

Delinquent Participant Contributions/Loan Repayments

VFCP Sections 7.1(a) and (c)

Facts:

- Company A’s pay periods end every other Friday. Each pay period, participant contributions total $10,000. Participant contributions reasonably can be segregated from Company A’s general assets by ten business days following the end of each pay period.

- Company A should have remitted participant contributions for the pay period ending March 2, 2001 to the plan by March 16, 2001, the Loss Date, but actually remitted them on April 13, 2001, the Recovery Date.

- Company A should have remitted participant contributions for the pay period ending March 16, 2001 to the plan by March 30, 2001, the Loss Date, but actually remitted them on April 13, 2001, the Recovery Date.

- Company A should have remitted participant contributions for the pay period ending March 30, 2001 to the plan by April 13, 2001, the Loss Date, but actually remitted them on May 15, 2001, the Recovery Date.

- In early 2004, a Plan Official discovers that participant contributions for these pay periods were not remitted on a timely basis. To comply with the Program, the Plan Official determined that she would pay all Lost Earnings on January 30, 2004.

Using The Online Calculator

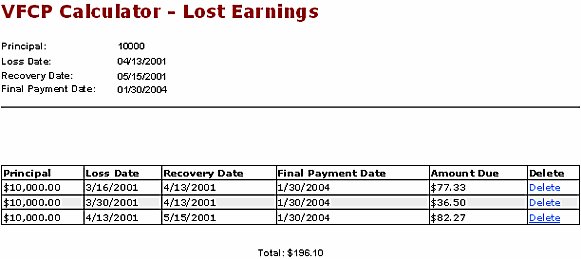

The applicant enters three sets of data into the Online Calculator: Each entry represents the data for one pay period.

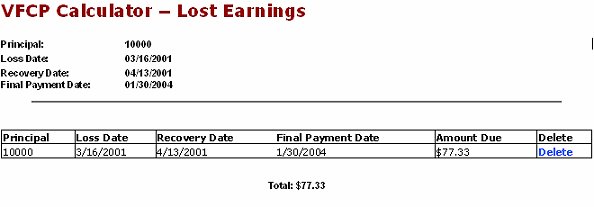

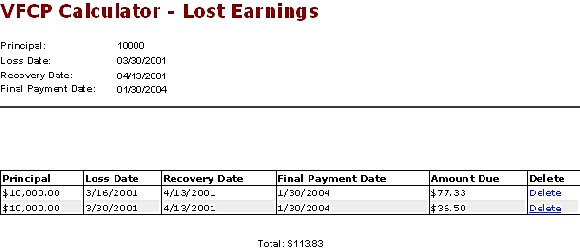

First Entry: (For pay period ending March 2, 2001)

- Principal Amount is $10,000

- Loss Date is March 16, 2001

- Recovery Date is April 13, 2001

- Final Payment Date is January 30, 2004

Second Entry: (For pay period ending March 16, 2001)

- Principal Amount is $10,000

- Loss Date is March 30, 2001

- Recovery Date is April 13, 2001

- Final Payment Date is January 30, 2004

Third Entry: (For pay period ending March 30, 2001)

- Principal Amount is $10,000

- Loss Date is April 13, 2001

- Recovery Date is May 15, 2001

- Final Payment Date is January 30, 2004

The Online Calculator provides a combined total of $196.10, which is the Lost Earnings and interest on Lost Earnings to be paid to the plan on January 30, 2004.

This same information would be entered for any additional pay period with untimely contributions. The chart under the Online Calculator will maintain a list of all data entered during the session. The Total number at the bottom of the chart shows the total amount of Lost Earnings and interest on Lost Earnings for all pay periods for which data was entered.

Note: If any Principal Amount has not been paid to the plan, this Principal Amount also must be paid to the plan and is not included in the total provided by the Online Calculator.

Performing The Calculation Manually

This example will show the manual calculation for the pay period ending March 2, 2001 only. However, the applicant must calculate Lost Earnings for each pay period and remit the total of all Lost Earnings to the plan.

The facts in this example are:

- Principal Amount is $10,000

- Loss Date is March 16, 2001

- Recovery Date is April 13, 2001

- Final Payment Date is January 30, 2004

To calculate earnings using applicable IRS Factors, use the basic formula:

Dollar Amount x IRS Factor

Step 1: Calculate Lost Earnings On The Principal Amount

First, the Plan Official must calculate Lost Earnings that should have been paid on the Recovery Date. The first period of time is from March 16, 2001 to March 31, 2001 (15 days), the end of the quarter. From the IRC 6621(a)(2) underpayment rate tables, the rate for this quarter is 9%. From the IRS Factor Table 23, the IRS Factor for 15 days at 9% is 0.003705021.

$10,000 x 0.003705021 = $37.05

The plan is owed $10,037.05 as of March 31, 2001. The second period of time is April 1, 2001 through April 13, 2001 (13 days). From the IRC 6621(a)(2) underpayment rate tables, the rate for this quarter is 8%. From the IRS Factor Table 21, the factor for 13 days at 8% is 0.002853065.

$10,037.05 x 0.002853065 = $28.64

Therefore, Lost Earnings of $65.69 ($37.05 + $28.64) must be paid to the plan.

Step 2: Calculate Interest On Lost Earnings

If Lost Earnings are paid to the plan after the Recovery Date, the Plan Official must also pay interest on the Lost Earnings from the Recovery Date to the Final Payment Date. How to perform this calculation is shown by the following table. The Interest column is the previous time period’s Amt. Due times the Factor. Amt. Due is the previous row’s Amt. Due plus Interest. The first row is based on the $65.69 Lost Earnings.

|

From |

To |

Days |

IRC |

IRS |

Factor |

Interest |

Amt. Due |

|

04/13/01 |

06/30/01 |

78 |

8% |

21 |

.017240956 |

$1.132558 |

$66.82256 |

|

07/01/01 |

09/30/01 |

92 |

7% |

19 |

.017798686 |

$1.189354 |

$68.01191 |

|

10/01/01 |

12/31/01 |

92 |

7% |

19 |

.017798686 |

$1.210523 |

$69.22243 |

|

01/01/02 |

03/31/02 |

90 |

6% |

17 |

.014903267 |

$1.031640 |

$70.25408 |

|

04/01/02 |

06/30/02 |

91 |

6% |

17 |

.015070101 |

$1.058736 |

$71.31281 |

|

07/01/02 |

09/30/02 |

92 |

6% |

17 |

.015236961 |

$1.086591 |

$72.39940 |

|

10/01/02 |

12/31/02 |

92 |

6% |

17 |

.015236961 |

$1.103147 |

$73.50255 |

|

01/01/03 |

03/31/03 |

90 |

5% |

15 |

.012404225 |

$0.911742 |

$74.41429 |

|

04/01/03 |

06/30/03 |

91 |

5% |

15 |

.012542910 |

$0.933372 |

$75.34766 |

|

07/01/03 |

09/30/03 |

92 |

5% |

15 |

.012681615 |

$0.955530 |

$76.30319 |

|

10/01/03 |

12/31/03 |

92 |

4% |

13 |

.010132630 |

$0.773152 |

$77.07634 |

|

01/01/04 |

01/30/04 |

30 |

4% |

61 |

.003283890 |

$0.253110 |

$77.32945 |

|

Total Interest on Lost Earnings: |

$11.64 |

||||||

Note: The last IRS Factor comes from the IRS Factor Tables for leap years.

The plan is also owed $11.64. This is the amount of interest on $65.69 (Lost Earnings on the Principal Amount) accrued between April 13, 2001, the Recovery Date, when the Principal Amount $10,000 was paid to the plan, and January 30, 2004, the Final Payment Date.

Therefore, the Plan Official must pay $77.33 to the plan on January 30, 2004, as Lost Earnings ($65.69) plus interest on Lost Earnings ($11.64) for the pay period ending March 2, 2001, in addition to the Principal Amount ($10,000) that was paid on April 13, 2001.

This same calculation must be done for each pay period with untimely employee contributions or participant loan repayments.

Note: If the amount of Lost Earnings and interest, if any, to be paid to the plan is greater than $100,000, the calculation must be redone for each pay period, using the IRC 6621(c)(1) underpayment rates.

Example 2

Below Market Interest Rates On Loans/Leases

VFCP Sections 7.2(b), (c), and (d); and 7.4 (c)(2)(iv)

Facts:

- The Plan made to a party in interest a $150,000 mortgage loan, secured by a first Deed of Trust, at a fixed interest rate of 4% per annum. The loan was to be fully amortized over 30 years. Monthly payments are $716.12. The fair market interest rate for comparable loans, at the time this loan was made, was 7% per annum. Monthly payments would have been $997.95. The difference in monthly payments is $281.83.

- Loan issued on March 1, 2004.

- Payment made on April 1, 2004 (Loss Date)

- Correction to be made on October 5, 2004. (Recovery Date)

Using The Online Calculator

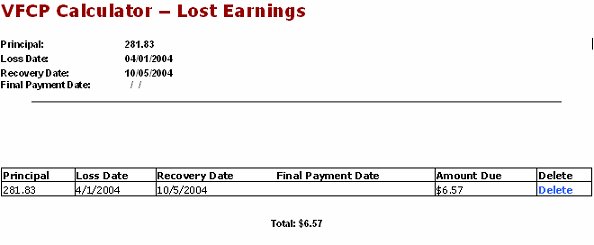

The applicant enters the following data into the Online Calculator:

- Principal Amount is $281.83

- Loss Date is April 1, 2004

- Recovery Date is October 5, 2004

- Final Payment Date is left blank, as Lost Earnings will be paid on the Recovery Date.

The Online Calculator provides a total of $6.57, which is the Lost Earnings to be paid to the plan on October 5, 2004.

The Plan Official must also pay the Principal Amount, which is not included in the total provided by the Online Calculator. Therefore, the amount to be paid is the Principal Amount ($281.83) plus Lost Earnings ($6.57) or $288.40.

This same information would be entered for each loan payment made (or lease payment received). The chart under the Online Calculator will maintain a list of all data entered during the session. The Total number at the bottom of the chart shows the total amount of Lost Earnings and interest on Lost Earnings due for all loan payments for which data was entered. The Plan Official must also pay the Principal Amount for each loan or lease payment, which is not included in the total provided by the Online Calculator.

In addition, if the loan was to a party in interest, the loan must be paid in full.

Performing The Calculation Manually

To calculate earnings using applicable IRS Factors, use the basic formula:

Dollar Amount x IRS Factor

The first period of time is from April 1, 2004 to June 30, 2004 (90 days), the end of the quarter. From the IRC 6621(a)(2) underpayment rate tables, the rate for this quarter is 5%. From the IRS Factor Table 63, the IRS Factor for 90 days at 5% is 0.012370127.

$281.83 x 0.012370127 = $3.486273

The plan is owed $285.316273 as of June 30, 2004 ($281.83 + $3.486273). The second period of time is July 1, 2004 through September 30, 2004 (92 days). The IRC 6621(a)(2) underpayment rate for this quarter is 4%. From the IRS Factor Table 61, the IRS Factor for 92 days at 4% is 0.010104808.

$285.316273 x 0.010104808 = $2.883066

The plan is owed $288.199339 as of September 30, 2004 ($285.316273 + $2.883066). The last period of time is October 1, 2004 through October 5, 2004 (5 days). From the IRC 6621(a)(2) underpayment rate tables, the rate for this quarter is 5%. From the IRS Factor Table 63, the IRS Factor for 5 days at 5% is 0.000683247.

$288.199339 x 0.000683247 = $0.196911

The plan is owed $288.39625 on October 5, 2004 ($288.199339 + $0.196911), which is rounded to $288.40.

Each loan payment must be separately calculated, and the amounts totaled. In addition, if the loan was to a party in interest, the loan must be paid in full.

Note: If the amount of Lost Earnings and interest, if any, to be paid to the plan is greater than $100,000, the calculations must be redone, using the IRC 6621(c)(1) underpayment rates.

Example 3

Purchase Of An Asset From A Party In Interest By A Plan

VFCP Sections 7.4(a), (d) and (f)

Facts:

- Plan purchased real estate from the plan sponsor in the amount of $120,000. At the time of the purchase, the FMV of the land was $100,000. The plan did not incur any transaction costs at the time of the purchase.

- Current FMV is $110,000

- Purchase Date: December 19, 2003 (Loss Date)

- Correction Date: October 5, 2004 (Recovery Date)

- Principal Amount: $120,000

Note: Alternatively, an independent fiduciary may determine that the plan would realize a greater benefit by keeping the asset. Correction would be made pursuant to Section 7.4(a)(2)(ii) of the VFCP.

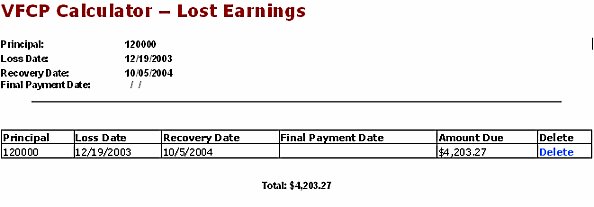

Using The Online Calculator

The applicant enters the following data into the Online Calculator:

- Principal Amount is $120,000

- Loss Date is December 19, 2003

- Recovery Date is October 5, 2004

- Final Payment Date is left blank, as Lost Earnings will be paid on the Recovery Date.

The Online Calculator provides a total of $4,203.27, which is the Lost Earnings to be paid to the plan on October 5, 2004.

Because the Principal Amount plus Lost Earnings ($124,203.27) is greater than the current fair market value ($110,000), the plan must sell the property (either back to the original seller or to a non-party in interest) for $124,203.27.

Note: If the current fair market value is $130,000, the plan would sell the property for $130,000.

Performing The Calculation Manually

To calculate earnings using applicable IRS Factors, use the basic formula:

Dollar Amount x IRS Factor

The first period of time is from December 19, 2003 to December 31, 2003 (12 days), the end of the quarter. From the IRC 6621(a)(2) underpayment rate tables, the rate for this quarter is 4%. From the IRS Factor Table 13, the IRS Factor for 12 days at 4% is 0.001315861.

$120,000 x 0.001315861 = $157.9033

The plan is owed $120,157.9033 as of December 31, 2003 ($120,000 + $157.9033). The second period of time is January 1, 2004 through March 31, 2004 (91 days). From the IRC 6621(a)(2) underpayment rate tables, the rate for this quarter is 4%. From the IRS Factor Table 61, the IRS Factor for 91 days at 4% is 0.009994426.

$120,157.9033 x 0.009994426 = $1,200.909

The total owed the plan on March 31, 2004 is $121,358.813. Continue calculating in the same manner.

|

From |

To |

Days |

IRC |

IRS |

Factor |

Interest |

Amt. Due |

|

04/01/04 |

06/30/04 |

91 |

5% |

63 |

0.012508429 |

$1,518.008 |

$122,876.821 |

|

07/01/04 |

09/30/04 |

92 |

4% |

61 |

0.010104808 |

$1,241.647 |

$124,118.467 |

|

10/01/04 |

10/05/04 |

5 |

5% |

63 |

0.000683247 |

$84.80357 |

$124,203.271 |

|

Total Interest (from table only): |

$2,844.45857 |

||||||

The total amount of Lost Earnings is $4,203.27087 ($157.9033 + $1,200.909 + $2,844.45857), which is rounded to $4,203.27.

Current FMV is $110,000.

The property must be sold for $124,203.27, the higher of the Principal Amount plus Lost Earnings ($120,000 + $4,203.27) or the current fair market value ($110,000).

If the amount of Lost Earnings and interest, if any, to be paid to the plan is greater than $100,000, the calculations must be redone, using the IRS 6621(c)(1) underpayment rates.

Example 4

Sale Of An Asset (Including Real Property) By A Plan To A Party In

Interest

VFCP Sections 7.4(b), (c) and (e)

Facts:

- A Plan sold real property to the plan sponsor for $120,000 on December 23, 2003. At the time of the sale, the FMV of the property was $125,000.

- The plan incurred $5,000 in transaction costs.

- Correction will take place on October 6, 2004

- Principal Amount is the amount by which the FMV of the asset at the time of the original sale exceeds the sale price ($5,000) plus the transaction costs ($5,000) for a total of $10,000.

- There are no determinable profits.

- An independent fiduciary has determined that the plan will realize a greater benefit if it receives the Principal Amount plus Lost Earnings than by repurchasing the asset.

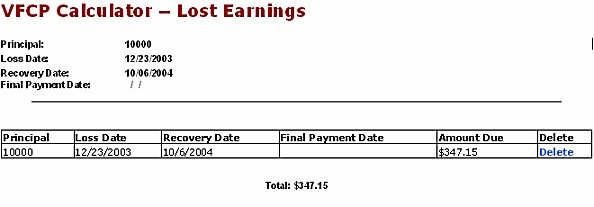

Using The Online Calculator

The applicant enters the following data into the Online Calculator:

- Principal Amount is $10,000

- Loss Date is December 23, 2003

- Recovery Date is October 6, 2004

- Final Payment Date is left blank, as Lost Earnings will be paid on the Recovery Date.

The Online Calculator provides a total of $347.15, which is the Lost Earnings to be paid to the plan on October 6, 2004. The applicant must also pay the Principal Amount, which is not included in the total provided by the Online Calculator. Therefore, the plan must receive $10,347.15.

Performing The Calculation Manually

To calculate earnings using applicable IRS Factors, use the basic formula:

Dollar Amount x IRS Factor

The first period of time is from December 23, 2003 to December 31, 2003 (8 days), the end of the quarter. From the IRC 6621(a)(2) underpayment rate tables, the rate for this quarter is 4%. From the IRS Factor Table 13, the IRS Factor for 8 days at 4% is 0.000877049.

$10,000 x 0.000877049 = $8.77049

The plan is owed $10,008.77049 as of December 31, 2003 ($10,000 + $8.77049). The second period of time is January 1, 2004 through March 31, 2004 (91 days). From the IRC 6621(a)(2) underpayment rate tables, the rate for this quarter is 4%. From the IRS Factor Table 61, the IRS Factor for 91 days at 4% is 0.009994426.

$10,008.77049 x 0.000877049 = $100.0319

The total owed the plan on March 31, 2004 is $10,108.8024. Continue calculating in the same manner.

|

From |

To |

Days |

IRC |

IRS |

Factor |

Interest |

Amt. Due |

|

04/01/04 |

06/30/04 |

91 |

5% |

63 |

0.012508429 |

$126.4452 |

$10,235.25 |

|

07/01/04 |

09/30/04 |

92 |

4% |

61 |

0.010104808 |

$103.4252 |

$10,338.67 |

|

10/01/04 |

10/06/04 |

6 |

5% |

63 |

0.000819952 |

$8.477215 |

$10,347.15 |

|

Total Interest (from table only): |

$238.347615 |

||||||

The total amount of Lost Earnings is $347.1500005 ($8.77049 + $100.0319 +$238.347615), which is rounded to $347.15.

The Principal Amount must also be paid to the plan. Therefore, the plan must receive $10,347.15 on October 6, 2004.

If the amount of Lost Earnings and interest, if any, to be paid to the plan is greater than $100,000, the calculations must be redone using the IRS 6621(c)(1) underpayment rates.

Example 5

Payment Of Benefits Without Properly Valuing Plan Assets On Which Payment

Is Based

VFCP Section 7.5

Facts:

- On December 31, 1998, a profit sharing plan purchased a 20-acre parcel of real property for $500,000, which represented a portion of the plan’s assets. The plan has carried the property on its books at cost, rather than at FMV. One participant left the company on January 1, 2003, and received a distribution on that date, which included her portion of the value of the property. The separated participant’s account balance represented 2% of the plan’s assets. As part of correction for the VFCP, a qualified, independent appraiser has determined the FMV of the property for 2001, 2002, and 2003. The FMV as of December 31, 2002, was $400,000. Therefore, this participant was overpaid by $2,000 (($500,000–$400,000) multiplied by 2%).

- Correction will take place on October 6, 2004.

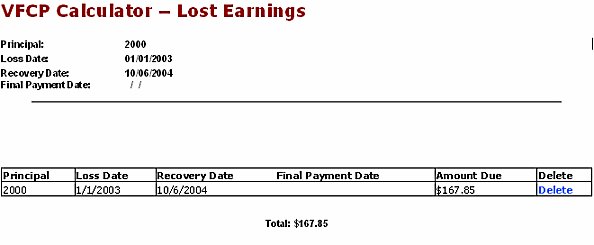

Using The Online Calculator

The applicant enters the following data into the Online Calculator:

- Principal Amount is $2,000

- Loss Date is January 1, 2003

- Recovery Date is October 6, 2004

- Final Payment Date is left blank, as Lost Earnings will be paid on the Recovery Date.

The Online Calculator provides a total of $167.85, which is the Lost Earnings to be paid to the plan on October 6, 2004. The applicant must also pay the Principal Amount, which is not included in the total provided by the Online Calculator. Therefore, the plan must receive $2,167.85.

Performing The Calculation Manually

To calculate earnings using applicable IRS Factors, use the basic formula:

Dollar Amount x IRS Factor

The first period of time is from January 1, 2003 to March 31, 2003 (89 days), the end of the quarter. From the IRC 6621(a)(2) underpayment rate table, the rate for this quarter is 5%. From the IRS Factor Table 15, the IRS Factor for 89 days at 5% is 0.012265558.

$2,000 x 0.012265558 = $24.53112

The plan is owed $2,024.53112 as of March 31, 2003 ($2,000 + $24.53112). The second period of time is April 1, 2003 through June 30, 2003 (91 days). From the IRC 6621(a)(2) underpayment rate tables, the rate for this quarter is 5%. From the IRS Factor Table 15, the IRS Factor for 91 days at 5% is 0.012542910.

$2,024.53122 x 0.012542910 = $25.39351

The total owed the plan on June 30, 2003 is $2,049.92463. Continue the calculations in the same manner.

|

From |

To |

Days |

IRC |

IRS |

Factor |

Interest |

Amt. Due |

|

07/01/03 |

09/30/03 |

92 |

5% |

15 |

0.012681615 |

$25.99635 |

$2,075.92098 |

|

10/01/03 |

12/31/03 |

92 |

4% |

13 |

0.010104808 |

$21.03454 |

$2,096.95552 |

|

01/01/04 |

03/31/04 |

91 |

5% |

63 |

0.000819952 |

$20.95787 |

$2,117.91339 |

|

04/01/04 |

06/30/04 |

91 |

5% |

63 |

0.000819952 |

$26.49177 |

$2,144.40516 |

|

07/01/04 |

09/30/04 |

92 |

4% |

61 |

0.010104808 |

$21.66880 |

$2,166.07396 |

|

10/01/04 |

10/06/04 |

6 |

5% |

63 |

0.000819952 |

$1.776077 |

$2,167.85004 |

|

Total Interest (from table only): |

$117.925407 |

||||||

The total amount of Lost Earnings is $167.850037 ($24.53112 + $25.39351 + $117.925407), which is rounded to $167.85.

The Principal Amount must also be paid to the plan. Therefore, the plan must receive $2,167.85 on October 6, 2004.

If the amount of Lost Earnings and interest, if any, to be paid to the plan is greater than $100,000, the calculations must be redone using the IRC 6621(c)(1) underpayment rates.

Note: Had the property increased in value to $600,000 on December 31, 2002, the participant would have been underpaid by $2,000. The exact same calculation must be done, but the participant would receive $2,167.85 rather than the plan.

Example 6

Duplicative, Excessive, Or Unnecessary Compensation Paid By A Plan;

Expenses Improperly Paid By A Plan; And

Payment Of Dual Compensation To A Plan Fiduciary

VFCP Sections 7.6(a), (b) and (c)

Facts:

- A service provider was inadvertently paid twice for services rendered. The plan paid $2,000 for an audit on January 15, 2003, and paid the same invoice again on March 15, 2003. The error was noticed, and correction will be made on October 6, 2004.

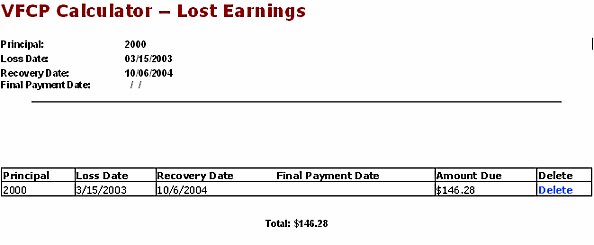

Using The Online Calculator

The applicant enters the following data into the Online Calculator:

- Principal Amount is $2,000

- Loss Date is March 15, 2003

- Recovery Date is October 6, 2004

- Final Payment Date is left blank, as Lost Earnings will be paid on the Recovery Date.

The Online Calculator provides a total of $146.28, which is the Lost Earnings to be paid to the plan on October 6, 2004.

The applicant must also pay the Principal Amount, which is not included in the total provided by the Online Calculator. Therefore, the plan must receive $2,146.28.

Performing The Calculation Manually

To calculate earnings using applicable IRS Factors, use the basic formula:

Dollar Amount x IRS Factor

The first period of time is from March 15, 2003 to March 31, 2003 (16 days), the end of the quarter. From the IRC 6621(a)(2) underpayment rate tables, the rate for this quarter is 5%. From the IRS Factor Table 15, the IRS Factor for 16 days at 5% is 0.002194034.

$2,000 x 0.002194034 = $4.388068

The plan is owed $2,004.388068 as of March 31, 2003 ($2,000 + $4.388068). The second period of time is April 1, 2003 through June 30, 2003 (91 days). From the IRC 6621(a)(2) underpayment rate tables, the rate for this quarter is 5%. From the IRS Factor Table 15, the IRS Factor for 91 days at 5% is 0.012542910.

$2,004.388068 x 0.012542910 = $25.14086

The total owed the plan on June 30, 2003 is $2,029.52893. Continue the calculations in the same manner.

|

From |

To |

Days |

IRC |

IRS |

Factor |

Interest |

Amt. Due |

|

07/01/03 |

09/30/03 |

92 |

5% |

15 |

0.012681615 |

$25.73770 |

$2,055.26663 |

|

10/01/03 |

12/31/03 |

92 |

4% |

13 |

0.010104808 |

$20.82526 |

$2,076.09189 |

|

01/01/04 |

03/31/04 |

91 |

5% |

63 |

0.000819952 |

$20.74935 |

$2,096.84123 |

|

04/01/04 |

06/30/04 |

91 |

5% |

63 |

0.000819952 |

$26.22819 |

$2,123.06942 |

|

07/01/04 |

09/30/04 |

92 |

4% |

61 |

0.010104808 |

$21.45321 |

$2,144.52263 |

|

10/01/04 |

10/06/04 |

6 |

5% |

63 |

0.000819952 |

$1.758406 |

$2,146.28104 |

|

Total Interest (from table only): |

$116.752116 |

||||||

The total amount of Lost Earnings is $146.28104 ($4.388068 + $25.14086 + $116.752116), which is rounded to $146.28.

The Principal Amount must also be paid to the plan. Therefore, the plan must receive $2,146.28 on October 6, 2004.

If the amount of Lost Earnings and interest, if any, to be paid to the plan is greater than $100,000, the calculations must be redone using the IRC 6621(c)(1) underpayment rates.

Example 7

Restoration Of Profits

Facts:

- Plan A purchased a parcel of real estate from a party in interest for $100,000 on August 20, 2002. The purchase price was at the fair market value, and the value has not increased or decreased. The party in interest purchased stock with the proceeds of the sale. On January 22, 2004, the party in interest sold the stock for $225,000. Therefore, the party in interest could determine that profits from the use of the Principal Amount were $125,000 ($225,000 less $100,000). Later that year, the Plan Official discovered that the original purchase was prohibited under ERISA. To comply with the Program, the Plan Official determined that he would pay the amount on November 17, 2004.

Using The Online Calculator

The applicant calculates both Lost Earnings and Restoration of Profits to determine the greater of these two amounts, which must then be paid to the plan.

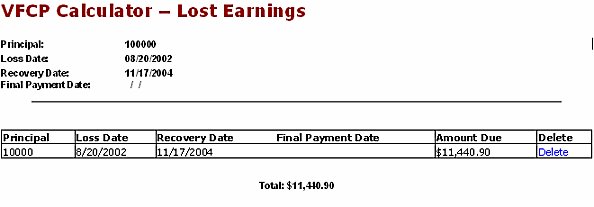

The applicant enters the following data into the Online Calculator to determine Lost Earnings:

- Principal Amount is $100,000 (the original purchase price)

- Loss Date is August 20, 2002

- Recovery Date is November 17, 2004

- Final Payment Date is left blank

The Online Calculator provides an amount of $11,440.90, which is Lost Earnings that would be paid to the plan on November 17, 2004. The transaction must also be corrected by the sale of the asset back to the party in interest who originally sold the asset to the plan, or to a person who is not a party in interest. Since the Principal Amount plus Lost Earnings ($111,440.90) is higher than the current fair market value ($100,000), the plan would receive $111,440.90, under the Lost Earnings calculation.

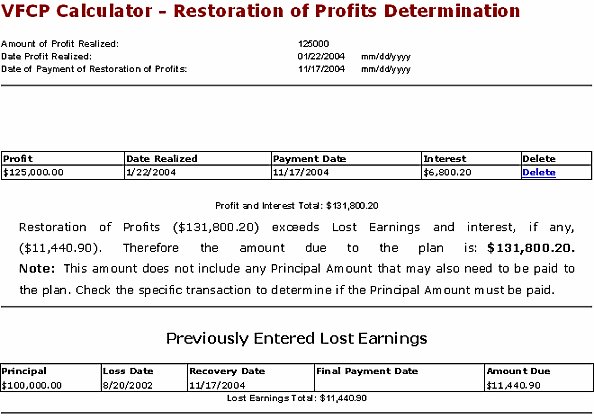

Because there are determinable profits, the applicant also selects the Calculate Restoration of Profits button.

The applicant enters the following data into the Online Calculator to determine Restoration of Profits:

- Amount of Profit Realized is $125,000

- Date Profit Realized is January 22, 2004 (date the stock was sold)

- Date of payment of Restoration of Profits is November 17, 2004

The Online Calculator provides an amount of $131,800.20, which is Restoration of Profits to be paid to the plan on November 17, 2004. Restoration of Profits is payable to the plan because it exceeds Lost Earnings and interest, if any, which totaled $11,440.90.

Performing The Calculation Manually

Step 1: Determine Lost Earnings

To calculate earnings using applicable IRS Factors, use the basic formula:

Dollar Amount x IRS Factor

The first period of time is from August 20, 2002 to September 30, 2002 (41 days), the end of the quarter. From the IRC 6621(a)(2) underpayment rate tables, the rate for this quarter is 6%. From the IRS Factor Table 17, the IRS Factor for 41 days at 6% is 0.006761931.

$100,000 x 0.006761931 = $676.1931

The plan is owed $676.1931 in Lost Earnings as of September 30, 2002. The second period of time is October 1, 2002 through December 31, 2002 (92 days). From the IRC 6621(a)(2) underpayment rate tables, the rate for this quarter is 6%. From the IRS Factor Table 17, the IRS Factor for 92 days at 6% is 0.015236961. Since Lost Earnings are based on the Principal Amount, the Principal Amount ($100,000) must be added to the Lost Earnings already determined.

$100,676.1931 x 0.015236961 = $1,533.999

The plan is owed $2,210.1921 ($676.1931 + $1,533.999) as of December 31, 2002. Continue calculating in the same manner.

|

From |

To |

Days |

IRC |

IRS |

Factor |

Interest |

Amt. Due |

|

01/01/03 |

03/31/03 |

90 |

5% |

15 |

0.012404225 |

$1,267.838 |

$103,478.0306 |

|

04/01/03 |

06/30/03 |

91 |

5% |

15 |

0.012542910 |

$1,297.916 |

$104,775.9462 |

|

07/01/03 |

09/30/03 |

92 |

5% |

15 |

0.012681615 |

$1,328.728 |

$106,104.6744 |

|

10/01/03 |

12/31/03 |

92 |

4% |

13 |

0.010132630 |

$1,075.119 |

$107,179.7938 |

|

01/01/04 |

03/31/04 |

91 |

4% |

61 |

0.009994426 |

$1,071.201 |

$108,250.9943 |

|

04/01/04 |

6/30/04 |

91 |

5% |

63 |

0.012508429 |

$1,354.05 |

$109,605.0442 |

|

07/01/04 |

09/30/04 |

92 |

4% |

61 |

0.010104808 |

$1,107.538 |

$110,712.5821 |

|

10/01/04 |

11/17/04 |

48 |

5% |

63 |

0.006578473 |

$728.3197 |

$111,440.9018 |

|

Total Interest (from table only): |

$9,230.7097 |

||||||

The total amount of Lost Earnings is $11,440.9018 ($676.1931 + $1,533.999 + $9,230.7097), rounded to $11,440.90, which would be paid to the plan on November 17, 2004, if Lost Earnings exceeds Restoration of Profits. The transaction must also be corrected by the sale of the asset back to the party in interest who originally sold the asset to the plan or to a person who is not a party in interest. Because the Principal Amount plus Lost Earnings ($111,440.90) is higher than the current fair market value ($100,000), the plan would receive $111,440.90, under the Lost Earnings calculation.

Step 2: Determine Restoration Of Profits, (Amount of Profit Plus Amount Of Interest, If Any)

The party in interest realized a profit of $125,000 on January 22, 2004, when the stock was sold. Because the correction will take place on November 17, 2004, which is after the date the profit was realized, an interest amount must be calculated. Since the profit already exceeds $100,000, the IRC 6621(c)(1) rate must be used.

To calculate interest using applicable IRS Factors, use the basic formula:

Dollar Amount x IRS Factor

The first period of time is from January 22, 2004 to March 31, 2004 (69 days), the end of the quarter. From the IRC 6621(c)(1) underpayment rate tables, the rate for this quarter is 6%. From the IRS Factor Table 65, the IRS Factor for 69 days at 6% is 0.011374754.

$125,000 x 0.011374754 = $1,421.84425

The plan is owed $126,421.84425 in Restoration of Profits as of March 31, 2004. The second period of time is April 1, 2004 through June 30, 2004 (91 days). From the IRC 6621(c)(1) underpayment rate tables, the rate for this quarter is 7%. From the IRS Factor Table 67, the IRS Factor for 91 days at 7% is 0.017555017.

$126,421.84425 x 0.017555017 = $2,219.33762

The plan is owed $128,641.1819 in Restoration of Profits as of June 30, 2004. Continue calculating in the same manner.

|

From |

To |

Days |

IRC |

IRS |

Factor |

Interest |

Amt. Due |

|

07/01/04 |

09/30/04 |

92 |

6% |

65 |

0.015195019 |

$1,954.7052 |

$130,595.8871 |

|

10/01/04 |

11/17/04 |

78 |

7% |

67 |

0.009221710 |

$1,204.3174 |

$131,800.2045 |

|

Total Interest (from table only): |

$3,159.0026 |

||||||

The total amount of interest on the profit is $6,800.20447 ($1,421.84425 + $2,219.33762 + $3,159.0026), which is rounded to $6,800.20. Therefore, Restoration of Profits is $131,800.20 (the $125,000 profit plus $6,800.20) which would be paid to the plan on November 17, 2004, if Restoration of Profits exceeds Lost Earnings. The transaction must also be corrected by the sale of the asset back to the party in interest who originally sold the asset to the plan or to a person who is not a party in interest. Because the Principal Amount (the original $100,000 sales price) plus Restoration of Profits ($131,800.2045) is higher than the current fair market value ($100,000), the plan would receive $231,800.20 under the Restoration of Profits calculation.

Step 3: Determine The Higher Of Lost Earnings Or Restoration Of Profits

Under the Lost Earnings calculation, the plan would receive $111,440.90. Under the Restoration of Profits calculation, the plan would receive $231,800.20. Therefore, since Restoration of Profits is greater than Lost Earnings, the plan must be paid $231,800.20 on November 17, 2004.

Glossary

- Correction Amount - For purposes of the VFCP, the correction amount is the amount that must be paid to the plan as a result of the breach in order to make the plan whole. In most instances, the correction amount will be a combination of the Principal Amount involved in the transaction, the Lost Earnings amount, which is earnings that would have been earned on the Principal Amount for the period of the transaction, and any interest on Lost Earnings. However, in circumstances when the Restoration of Profits amount exceeds the Lost Earnings amount and any interest on Lost Earnings, the correction amount will be a combination of the Principal Amount and the Restoration of Profits amount. See Section 5(b) of the VFCP.

- Department - The U.S. Department of Labor.

- EBSA - The Employee Benefits Security Administration.

- FMV - Fair market value. Fair market value determinations shall be made in accordance with Section 5(a) of the VFCP.

- Final Payment Date - The date on which (i) Lost Earnings is paid to the Plan, if later than the Recovery Date, or (ii) Restoration of Profits is paid to the plan, if later than the date the profit was realized.

- IRC - The Internal Revenue Code of 1986, as amended.

- IRS - The Internal Revenue Service.

- Loss Date - The date that the plan lost the use of the Principal Amount. See Section 5(b)(3) of the VFCP.

- Lost Earnings - Lost Earnings is intended to approximate the amount that would have been earned by the plan on the Principal Amount, but for the breach. See Section 5(b)(5) of the VFCP.

- Online Calculator - An Internet based compliance assistance tool provided on EBSA’s Website that permits applicants to calculate the amount of Lost Earnings, any interest on Lost Earnings, and the interest amount for Restoration of Profits, if applicable, for certain transactions. The Online Calculator will be updated as necessary. See Section 5(b)(7) of the VFCP.

- Plan Official - A plan fiduciary, plan sponsor, party in interest with respect to a plan, or other person who is in a position to correct a breach. See Section 3(b)(2) of the VFCP.

- Principal Amount - The amount that would have been available to the plan for investment or distribution on the date of the breach, had the breach not occurred. The Principal Amount, when applicable, must be determined for each transaction by reference to Section 7 of the VFCP. Generally, the Principal Amount is the base amount on which Lost Earnings and, if applicable, Restoration of Profits is calculated. The Principal Amount shall also include, where appropriate, any transaction costs associated with entering into the transaction that constitutes the breach. See Section 5(b)(2) of the VFCP.

- Recovery Date - The date that the Principal Amount is restored to the plan. See Section 5(b)(4) of the VFCP.

- Restoration of Profits - If the Principal Amount was used for a specific purpose such that a profit on the use of the Principal Amount is determinable, the Plan Official must calculate the Restoration of Profits amount and compare it to the Lost Earnings amount to determine the correction amount. “Restoration of Profits” is a combination of two amounts: (i) the amount of profit made on the use of the Principal Amount by the fiduciary or party in interest who engaged in the breach, or by a person who knowingly participated in the breach, and (ii) if the profit is returned to the plan on a date later that the date on which the profit was realized (i.e., received or determined), the amount of interest earned on such profit from the date the profit was realized to the date on which the profit is paid to the plan. If the Restoration of Profits amount exceeds Lost Earnings and interest, if any, the Restoration of Profits amount must be paid to the plan instead of Lost Earnings. See Section 5(b)(6) of the VFCP.

- VFCP (Program) - The Department’s Voluntary Fiduciary Correction Program. See Federal Register.