Employers

Employers are essential to the child support program. Employers deduct child support and medical support obligations from employee’s pay, accounting for nearly 70 percent of child support collections.

Employers are essential to the child support program. Employers deduct child support and medical support obligations from employee’s pay, accounting for nearly 70 percent of child support collections.

Employers also…

- Save taxpayer dollars. Child support collections reduce public assistance spending.

- Prevent and reduce fraud. Federal and state agencies use new hire employment information to reduce overpayments in public assistance, unemployment and disability insurance, and workers’ compensation benefits.

Employers have four primary responsibilities:

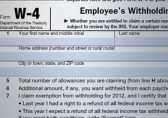

- Report newly hired and terminated employees

- Withhold child support payments as ordered

- Enroll children in health care coverage

- Remit child support to the State Disbursement Unit

News RSS Feed

Upcoming presentations: October!

September 14, 2012Employers Now Required to Report Rehired Employees

September 14, 2012Employers Working with Tribes

August 29, 2012

Related Pages

Featured Resources

Acceptance of Standard Verification of Employment (VOE) Response

September 11, 2012

The Child Support Program and Employers

July 1, 2003

Three Things Every Employer Must Know About Child Support

March 28, 2012

What Courts and Attorneys Must Know About Income Withholding

August 18, 2011

Working with the Military as an Employer

March 1, 2012

Private Collection Agency, State Policy Matrix

February 2, 2010

Three Things Every PEO Must Know About Child Support

March 29, 2012

Multistate Financial Institution Data Match Election Form & Instructions

November 1, 2008

Additional Resources for Employers RSS Feed

e-IWO Release 13-01 Minor: Specifications

October 4, 2012Provides record specifications for the e-IWO application's new suspense disposition code and query for employer informationIncome Withholding Form - State Contacts and Program Information

October 2, 2012Provides the links to state income withholding (IWO), SDU, and EFT/EDI contact and program information needed to process an IWO formFederal Agency Medical Support Contacts and Program Information

October 1, 2012Provides where states should send medical support notices to federal agenciesState Lump Sum Contacts and Program Information

October 1, 2012Provides information about state requirements and contacts for reporting and withholding lump sums and bonusesState Electronic Interstate Exchange Program Information

October 1, 2012Matrix displaying which states are sending/receiving interstate payments electronically with other states

Income Withholding Form - State Contacts and Program Information

October 2, 2012Provides the links to state income withholding (IWO), SDU, and EFT/EDI contact and program information needed to process an IWO formHow to Identify Treasury Checks

May 18, 2012Information on Department of the Treasury's Financial Management Service and how to read a Treasury paper checkState Disbursement Unit Contacts and Program Information

October 1, 2012Provides State disbursement unit (SDU) contact information for employers and other state child support agenciesState New Hire Reporting Contacts and Program Information

August 1, 2012State-specific requirements and contacts for employers regarding the reporting of newly hired employees (new hires)Revised Income Withholding for Support (IWO) Form

May 16, 2011Provides the revised Income Withholding for Support (IWO) Form and instructions and highlights recent changes