Turbines on the Shirley Wind Farm near Green Bay, Wisconsin. Renewable energy represents one of the biggest economic opportunities for the global economy, and with a few small changes in how we finance projects like these, we can help make it easier and more affordable to bring clean energy to families and businesses nationwide. | Photo courtesy of Nordex USA.

Editor's Note: This article originally appeared on Huffington Post.

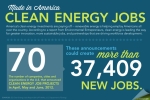

Over the past four years, we have seen tremendous progress in the development and deployment of renewable energy technologies that should give us all hope that America can lead in the global clean energy economy. These technologies are helping to create new jobs and new industries domestically, while reducing carbon pollution and helping to address the challenges of climate change.

Want more reasons to be optimistic about driving progress in the development and deployment of renewable energy? Just look at some of the most significant challenges we face -- and how easy it could be to overcome them. While the technological advances are exciting, there is also important work to do in the other aspects of clean energy, particularly as it relates to financing. For a variety of reasons, including provisions in the tax code, it can cost over 10 percent more to finance a renewable energy project than it does a traditional energy project. But with a few small changes in how we finance renewable energy projects, we can help to make it easier and more affordable to bring clean energy to families and businesses nationwide.

A few things to keep in mind:

1. Renewable energy is reliable, the technologies work, and costs are dropping dramatically. Deploying the technologies globally and at scale has helped costs to decline far faster than almost anyone could have anticipated. Solar costs, for example, are down more than 75 percent over the last four years. As Neil Auerbach of Hudson Clean Energy put it, "renewable energy is the only energy source that gets cheaper the more it is deployed."

2. As the industry gets to scale, the importance of reducing non-hardware (or so called "soft costs") becomes increasingly important. In the case of solar, equipment costs now account for just 46 percent of the total costs of an installed system, with 54 percent of the total coming from everything else, including installation, financing, insurance and permits. There are ways to bring these soft costs down that don't require major technology breakthroughs. That's why the Energy Department is partnering with industry to look at everything from standardizing building permits to construction techniques to new insurance products to do just that.

3. Helping to expand access to and reduce the cost of financing projects is a critical step in significantly reducing overall project costs. Renewable energy projects in the U.S. rely upon an old-fashioned, antiquated form of financing that's different from how other parts of the U.S. economy are financed. Rather than using bond or stock markets, projects depend on non-capital markets sources of investment, like banks, where the cost of capital can approach typical private equity rates of return of 12-15 percent. The Energy Department has been pursuing multiple avenues to help expand capital markets financing for renewable energy that could potentially halve the cost of accessing equity capital and drive down other costs of financing as well. Again, these reductions in costs don't require going to the lab; they involve applying financing techniques that are widely used in other parts of the economy, but have not yet been applied to this sector.

4. In addition to deploying cleaner sources of energy, we can achieve dramatic reductions in carbon pollution by investing in cost-effective energy efficiency improvements. Financing is a key constraint here as well, since lenders are not certain that investments in efficiency will either work as advertised, whether the borrower will save or spend the savings, or whether the building will be worth more after the investments have been made. Additionally, a lack of standardized contracts makes it difficult to bundle small projects into securities that would attract the interest of institutional investors. Despite these difficulties, we are working with industry and other stakeholders to find solutions to these contracting and data challenges. And like with renewable energy, we can be optimistic because technology isn't the binding constraint -- it's about finding ways to mobilize proven financing instruments that already exist elsewhere and applying it to this growing global sector.

5. If we begin thinking about energy projects as financial assets, as well as energy assets, we can help to encourage additional, smart investments in these industries. Currently, renewable energy and energy efficiency projects offer investors something that, between a volatile stock market and low interest rates, is very difficult to find: current yields.

Basically, we have an asset-liability mismatch. The banks and non-capital markets that are currently the primary financiers in the renewable energy sector are generally looking for short-term yields. Renewable energy projects, however, are typically longer-term investments that provide stable returns over long periods of times (15 or 20 years, for example). Longer-term investments like these are very appealing to pension funds or insurance companies that need long-term yields to match their long-dated liabilities. However, because renewable energy projects currently aren't able to seek investment in capital markets, new classes of investors who want to invest in renewable energy projects can't. Fixing this mix-match would reduce financing costs for projects, further reducing the overall cost of clean energy. That's good for investors, good for project developers, and good for American consumers.

6. We can be optimistic because most Americans support investments in clean energy. This includes strong bipartisan support for clean, renewable energy at the state level, with over a dozen states currently developing their own clean energy finance entities.

But while reasons remain to be hopeful about the progress of the industry, there are serious headwinds that could have a significant impact on America's clean energy industry, and we cannot be complacent. We are making gains globally in the clean energy race, but much of that progress is due to government programs and support that are coming to an end. In fact, 75 percent of U.S. government support programs -- including the 1705 loan guarantee program, the 1603 program to provide tax grants in lieu of tax credits and the Production Tax Credit -- have expired or are set to expire soon.

Throughout our country's history -- from aviation to agriculture, from biotechnologies to computer technologies -- the federal government has supported the private sector to keep the United States at the technological forefront of important industries. To seize the clean energy opportunity, we must do so again -- and we must act now.

Around the world, countries recognize that renewable energy represents one of the biggest economic opportunities for the global economy. There are some in Washington, however, who think we can't compete with other countries, who think that we have already lost the clean energy race.

I can tell you firsthand, the clean energy industry in the U.S. is able and prepared to produce real energy for American consumers.

By combining America's historic leadership in technological and manufacturing innovation with improvements in how we finance renewable energy and energy efficiency projects across the country, we can once again lead the world in this critical sector.