by: Autumn

A Voluntary Self-Disclosure (VSD) is when companies willingly disclose a violation or a suspected violation of the Foreign Trade Regulations (FTR). This disclosure is accompanied by the corrective actions taken in AES, it means you must correct shipment information or file for shipments that were not filed previously.

Submitting a VSD with the U.S. Census Bureau provides you the opportunity to mitigate potential penalties, as well as document discovered errors and corrections. If violations are known, we strongly encourage you to file VSDs to ensure proper due diligence with the FTR. See section 30.74.

Tips When Submitting Voluntary Self-Disclosures

- Address to: Chief, Foreign Trade Division. Make sure that your letter is on company letterhead, contains a point of contact, a detailed description of when and how the violations occurred, any mitigated circumstance, and the corrective actions taken.

- Disclosures For Multiple Years. When correcting or filing shipment information into the AES for time periods (up to five years), begin with the most current year (e.g., 2013, 2012, 2011, etc.)

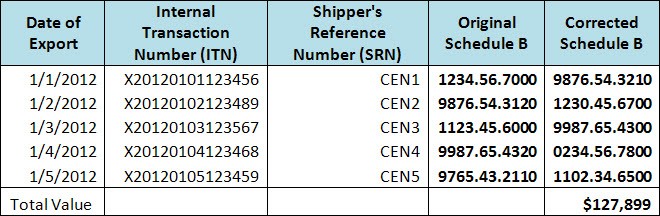

- Provide Complete Descriptions. You must include a description of the error and correction. Below is an example of a preferred format to submit the corrected information. Detailed account of the type of violation. The detailed account should include an accurate description of the type(s) of violation(s) that occurred. It can be included as an attachment to the letter or may be sent later (via mail or e-mail). Preferably submit in excel format.

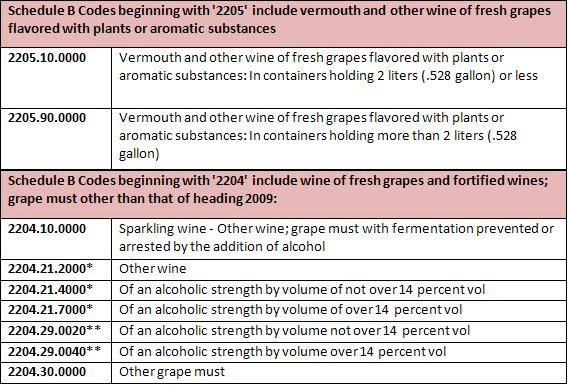

In the above image, Schedule B numbers were reported incorrectly for five shipments. The disclosure included the corresponding ITNs, and the original and corrected Schedule B numbers.

Make sure that you have all the information when submitting a disclosure. VSDs that do not have all the pertinent information might not be used for a mitigating factor. Complete procedures for filing VSDs can be found here.

For more information about filing a VSD with the U.S. Census Bureau, please contact the Regulations, Outreach, and Education Branch at 1-800-549-0595, option 3.

USATradeOnline

USATradeOnline