Welcome to The Simple Dollar! If this is your first time visiting the site, read my story and my key simple ideas for improving your finances and your life. Also, don't miss my free plan for improving your finances in 31 days.

Pack Food and Beverages (344/365)

Whenever I leave my house and expect that the travel to my destination is going to take more than an hour or so, I pack snacks and beverages. It’s just part of my routine.

Usually, I fill up a water bottle and add a bit of lemon juice to it, and I’ll look in the pantry to see what we have on hand for snacks. My snack of choice on the road is usually unsalted nuts or a low-sodium trail mix (I actually dislike foods with much salt in them).

I’ll grab these items, toss them in a canvas bag, and head to the car.

Why is this a part of my routine? It saves me money – a surprising amount of money, actually.

When I’m on the road for a while, eventually I’ll get hungry or thirsty. The same is true if I sit in the airport for a long while. I’ll want something to eat or drink, and the longer I travel, the stronger that desire gets.

So, what are my options? I can hit a gas station or convenience store, where the selection is awful and overpriced, but at least it’s quick and close to the road. I can hit a grocery store, but that takes much longer and is further from the road. I can hit a fast food restaurant, but that also takes a bit of time, isn’t very healthy, and also has a cost.

In both of these cases, I’m spending time and money just to sate my appetite on the road. I would rather just get to my destination, and I’d prefer to do it without spending too much cash.

Thus, it makes a whole lot of sense to just toss snacks from my pantry and a water bottle into the car.

First of all, a refillable water bottle makes for a very inexpensive beverage. I put a few ice cubes in there, fill it up with water, and it provides me with plenty of water for the trip for just a penny or two.

Second, snacks from home have the same advantages as a grocery store stop, but without wasting the travel time. I try to keep travel snacks on hand (such as unsalted nuts), and I naturally buy them at the grocery store as part of a normal grocery trip. Buying these adds perhaps another minute to a normal grocery trip, but stopping while traveling can eat as much as half an hour.

Even more importantly, I have a nearly infinite selection of food options when I pack at home. I can choose healthy things, or I can choose comfort foods. I can choose water, or I can choose a beverage to pump my energy a bit. If I have these on hand at home, I can take them with me, and if they’re at the grocery store, I can easily have them at home.

Now, multiply all of this by five. Why? I’m usually traveling with four other people – my wife and our three children. If everyone has a water bottle and a snack, we can make the four hour road trip to visit extended family without stopping at all, and that means the fastest possible trip with very little cost for snacks.

Plan ahead a bit when you travel and you’ll find that money doesn’t leak out of your pocket along the way.

This post is part of a yearlong series called “365 Ways to Live Cheap (Revisited),” in which I’m revisiting the entries from my book “365 Ways to Live Cheap,” which is available at Amazon and at bookstores everywhere. Images courtesy of Brittany Lynne Photography, the proprietor of which is my “photography intern” for this project.

Reader Mailbag: Popcorn, Old Movies, and a Warm Blanket

What’s inside? Here are the questions answered in today’s reader mailbag, boiled down to five word summaries. Click on the number to jump straight down to the question.

1. Using Roth to buy house

2. Children and educational tools

3. Is a charity legit?

4. Preparing for higher taxes

5. Shaving expenses

6. Inexpensive board game gifts

7. Investments used for debt repayment

8. Preparing for stay-at-home parenting

9. Graduates: savings or debt repayment?

10. Online alternative to magazine writing

Popcorn, old movies, and a warm blanket. Is there a better way to spend a cold weekend afternoon?

Q1: Using Roth to buy house

My husband and I live in a house that would sell for about $650K. We have a 15-year mortgage on it for $338K at 2.875% ($2314 per month P&I; $336.5K remaining—we very recently refinanced). We purchased the house in November of 2004 for $525K, and we have spent a fair amount of money invested in it in the form of repairs and upgrades. For example, we had to build a completely new garage this year to the tune of $40K.

It is a good house in a great neighborhood, but there are some things about it that I don’t like and I am considering moving to another house. The catch is that I don’t really want to sell our current house, given the great interest rate we have, the costs of selling, and given the money we have spent on repairs and upgrades. If we move (assuming that it’s okay with the lender of our mortgage, since we refinanced so recently as owner-occupied), we will stay in the same neighborhood; it is important to me that our two girls stay in the same elementary school, which is one of the best in our city. I’d estimate (with the help of Zillow and comparative rent listings) that we could rent our house for about $2500, which wouldn’t quite cover our total monthly expenses ($2800 with insurance and taxes). I’ve researched the process of renting quite a bit, and I know there are some drawbacks, but I like the idea of holding onto our house and having someone else pay down the principle. It goes down quickly on our 15-year loan. I also like the idea of having the house available to sell, should we need the money.

There are some houses on the market from time to time that look very attractive. For example, right now, there is one nearby for $699K (but I think it will go for more). I don’t want to pay PMI, so we’d need to come up with at least $140K for a down payment. We’d have to go for a jumbo, 30-year loan.

We earn $200K per year and have saved quite a bit for retirement. Between the two of us, we have about $393K in 401(k)s and $140K in Roths. We contribute the maximum to our 401(k)s every year and have until this year contributed the maximum to the Roth (our income now prevents further contributions). We have $60K in mutual funds (Vanguard), $95K in 529s, $10K in an emergency fund (which we should build higher), and our savings account fluctuates but is usually about $15K. Other than our house, we have no debt.

My question is: Would it make sense to take $80K out of our Roth to combine with our $60K in stocks so that we could make a 20% down payment? I know the general thought is to never, ever take money out of your retirement funds. I estimated that if that $80K made 5% per year for 30 years, it would be worth $357K, which is substantial. However, if we rented our house for only 15 years, we would have paid off a $336.5K mortgage in half the time.

- Carrie

Taking money out of the Roth loses the big advantage of a Roth: the fact that you don’t have to pay income taxes on the gains once you reture.

If you take the money out now, you’re going to immediately owe income taxes on whatever the gains were on that money, as well as an early withdrawal penalty. This can eat up a pretty sizeable portion of the money you made on the Roth. Here’s the full details.

Will you make a return good enough on the real estate investment to make up for that? It’s hard to say, but I’d suggest that you’d have to have a very strong return to make up for it. It relies on you finding renters for the house, that the renters will absolutely be perfect and cause no damage to the home, that you’ll never be without renters, and there will be no repairs on the home. It also seems not to include insurance and property taxes and the other costs that are needed to maintain a home. Overall, I would probably not make this move.

Q2: Children and educational tools

What kinds of tools do you use with your children to teach them things like reading and basic math skills? We’re really struggling with this at home. It seems like there are really three areas that matter – educational value, time investment, and cost. Every option we’ve found is great in two of those areas and fails in the third.

- Mindy

With all else being equal, we choose to invest more time.

We read a lot of books – at least half an hour a day of reading as a family, and usually substantially more than that. This includes reading aloud and sustained silent reading. We use homemade flash cards to work on math skills, since lightning-fast arithmetic is a huge help when it comes to mathematics all the way along. We have conversations about everything from politics and history to science and life skills.

It takes time, sure, but it’s worth it. Every hour you spend on things like this pays off. You can see it in your child. Spend your money on other things – spend your time on your kids.

Q3: Is a charity legit?

Tax deductible charities must be qualified under the tax code in order to deduct donations. The IRS publishes a list. This is not an endorsement and the charity may have high overhead, bad management, etc, but it does allow the individual taxpayer to look up a charity. Individual states may have separate licensing requirements, but for federal tax purposes, this is the list:

http://www.irs.gov/Charities-&-Non-Profits/Search-for-Charities

- Jim

This is a very useful database if you’re not sure whether or not the charity you’re looking at is a tax-deductible charity. If you’re not absolutely sure, it’s worth a look.

Of course, for most people, this is a pretty minor issue. You have to itemize your tax deductions in order to be able to claim this and the vast majority of people (aside from homeowners) are going to find the standard deduction to be a better deal for them.

If you’re a homeowner, though, or a person who gives a lot to charity, this can be a valuable link.

Q4: Preparing for higher taxes

Well, it looks like the federal government is headed straight towards higher taxes and there’s nothing that we the voters can do about it. What kind of steps should we take to prepare for the onslaught of taxes coming our way next year?

- William

I think higher taxes are an inevitability, since no one in Washington is actually talking about the level of cuts that would be needed to balance the budget without raising taxes. The amount of cutting that would have to happen to avoid raising taxes is immense. Talking about things like the National Endowment for the Arts or the Corporation for Public Broadcasting are just distractions, since eliminating them entirely would barely scratch the surface of the problem.

So, what can people do once they recognize that higher taxes are an inevitability? Generally, the best tactic is to accelerate income and defer tax-deductible expenses.

How do you do that? You can accelerate income by selling off things right now rather than waiting until next year. If you own any property you’re thinking of selling, you may want to consider doing it now and paying taxes on it now while rates are still quite low.

As for deferring taxes, you can do that by bumping up your 401(k) or your IRA contributions when the tax rates start to go up. Those investments look better when you’re paying a high tax rate now because you’re essentially choosing to pay the taxes on them later on.

Still, unless you’re rich, the moves you might make aren’t going to have any sort of a life-changing impact on your taxes. You’ll see an impact of a few percentage points on whatever moves you make and that’s about all.

Q5: Shaving expenses

I hate spending big money on shaving supplies and have even tried the route of the straight razor. It wasn’t for me.

I did purchase, and continue to use, a badger hair shaving brush. I also buy home made shaving soap off of eBay at an incredibly low cost. a $3 bar of shaving soap will last me nearly a year! It certainly cuts down on shaving cream expense and it creates just as good of a lather as the cans.

I haven’t found any better razor than the multiple razor blade heads, which cost a fortune. I came across a disposable razor sharpener in one of my favorite catalogs and bought it last year in hopes of saving some money in blade cartridges down the road.

https://www.lehmans.com/p-675-disposable-razor-sharpener.aspx

The initial cost has already paid for itself and is saving me money. I am starting month 11 on the same cartridge. Where I would once go through the blade replacement cartridges every two weeks or so, I am now getting months of use out of them.

The shaving brush, shaving soap and razor sharpener have decreased my shaving expenses significantly.

- Leon

I tend to shave in the shower, which I’ve found saves me even more money. With a constantly wet face and occasional rubdowns with a soapy rag, I can usually shave my face in about a minute or so, which amounts to 1.5 gallons of water used (a fraction of a cent), but means no shaving brush or shaving soap needed.

I tried shaving with an old-school safety razor with replaceable blades, but I must be awfully clumsy because I kept cutting myself terribly bad, to the point that I needed to stop using it lest my face look like a crisscross of scars. If you’re going this route, be careful.

Still, shaving is one of those things where you are consistently leaking money if you’re not mindful of it. Look at what you’re doing, figure out your total cost per shave, and see if there aren’t ways to reduce that cost per shave without making a shave difficult on you. If you can shave off five cents from a daily shave, then you’re saving $18 a year. Trim a quarter off of your daily shave and you’re saving about $91 per year.

Q6: Inexpensive board game gifts

I’m looking for some inexpensive ($20 or less) gift ideas for a few of my friends. I’m thinking of getting them games we can play together. I have some Amazon gift cards so it would be helpful if it wasn’t anything too obscure.

- Geoff

Four quick game suggestions:

Fleet is a card game for two to four players that plays in about forty five minutes regardless of the player count. In the game, you’re the head of a fishing fleet that’s racing with other fishing fleets to see who can get the largest haul out of a particular fishing area. It has surprising depth for a game of that length.

Sleuth is a wonderful deduction/logic game for three to seven players. Sleuth is a lot like Clue, except without the board. There’s a deck of cards that depict certain gem arrangements (such as “red diamond solitaire” or “yellow ruby pair”) with three traits (color, gem, and setting). At the start of the game, one is put aside (the “stolen” gem arrangement that you’re sleuthing for) and the rest are distributed to the players, and the rest of the game involves asking other players about the contents of their hands and using that along with what you know about the cards in your hand to figure out what the “stolen” card is.

The Resistance is a very fun and quick game for five to ten players. At the start of the game, each player is given a hidden card that says whether they’re “loyal” or that they’re a “traitor,” with many more loyal than traitor. Over the course of five rounds, different groups of the players (as elected by all of the players) will go on “missions” where they each lay face down one of two cards – “mission succeeds” or “mission fails.” If three missions fail, the traitors win; otherwise, the loyalists win. It’s very simple, very quick, and very fun.

Summoner Wars is a fantasy tactical card game for two players that takes about thirty minutes or so. Essentially, the two players spend their turns adding units to the battlefield (each unit is represented by a card) and then move their units around on the board (which is just a 6 x 8 grid) so that the units can fight each other (by rolling dice). The player who is able to most effectively position his or her units and use their resources most effectively will win. This game has tons of replayability.

Hopefully, you can find something that clicks among these four games.

Q7: Investments used for debt repayment

I would like your advice on possibly cashing in a mutual fund(s) to pay off some debt. We currently have a little over $80K in mutual and retirement funds. We also have about $15K in debt with a home line-of-credit. The APR is a fixed 4%, and the interest is tax deductable. The monthly interest is about $60, and we pay that plus at least an additional $200 towards the principal, for a monthly payment of around $260. We have a $65K mortgage, no car payments, and we’re able to pay off our credit cards each month. I contribute $160 monthly to a retirement fund, plus I work for a large city which funds a pension and contributes $350 per month to a retirement account, so we’re currently contributing about $500 per month towards retirement. Should I cash out one of my non-retirement mutual funds to pay off the debt? That would free up at least $260 a month that we could use towards retirement investing or building up our savings cushion, but that would obviously knock our savings down to $65K, plus I’m sure we would be paying extra in taxes for any profit made from the sale of a mutual fund. Is it worth doing it? Or should I let the funds grow and pay off that debt slowly but surely since the rate is relatively low and tax deductable? Any advice or info is greatly appreciated.

- Shaun

If it’s just an ordinary mutual fund and you’re not saving for a specific goal in the future and you’ll still have a lot in savings, I would do this.

Essentially, what you’re doing is locking in a 4% return on your money, but you’re also drastically reducing your monthly bills, which will give you a lot more flexibility and freedom. In your current position, a sudden market downturn and a job loss would hobble you greatly, but if you’re debt free, you sail through it. You also have much more freedom to make challenging career choices that aren’t at the whim of the market.

If there’s nothing else standing in the way that you haven’t mentioned, I’d go for it.

Q8: Preparing for stay-at-home parenting

My husband and I have decided that, in three years, we’re going to actively try to have a child and, if we do, I’m going to be a stay-at-home parent for a while for the child (or children). What can we start doing now to prepare for this situation?

- Chloe

Save every dime you can.

Right now is the moment to start engaging in frugality and to set up a savings plan for the future. You now have a very clear goal with a very clear timetable, so you can figure out what you’re going to need financially when you get there and how long it’s going to take you to get there.

Sit down and do these calcuations now. What is a monthly budget going to look like for you when the baby comes? What will be your home’s income level at that time? Use your best estimates, and if you’re not sure, assume low on the income and high on the expenses (you’ll never regret doing that, but you will probably regret miscalculating the other way).

Once you know what you’re going to need, figure out how much per month you’re going to have to start saving right now so that you can do this comfortably and without worry, then aim for that number. In fact, aim a little over that number.

It will be so much easier to handle stay-at-home parenting if you have cash in the bank.

Q9: Graduates: savings or debt repayment?

Currently, my husband and I have a large amount of debt between credit cards and students loans. My husband currently makes the most money by far and if he lost his job we would be in dire straits. We currently have saved about $14K in our bank accounts, but we have about $60K worth of debt with the student loans/credit cards. Our mortgage is $2,200 per month. I work a very small, part-time job right now and hope to get a good, full-time job after I graduate in December. Which do you think is better – paying down more debt and not continue to build up our savings, concentrate on putting more into savings and paying the minimum towards debt, or some type of combination? I’d appreciate any advice you can give.

- Mindy

How crowded is your husband’s field? Would he be re-employed fairly quickly? Or would he be facing a very competitive job market?

The harder it would be for him to find comparable employment, the more I would focus on having an emergency fund. If he’s in a specialized field without much competition and he has a lot of industry contacts, then I’d look more at the debt repayment.

The decision really comes down to your husband’s career situation.

Q10: Online alternative to magazine writing

I love reading well-written in-depth articles. I avidly read magazines like The New Yorker and The Atlantic and so on. The problem is that I get tired of the buildup of magazines around my house. What’s the electronic online alternative to this? I don’t want to buy an iPad or something like that just to read good articles without killing lots of trees. This seems like something you’d know.

- Laura

I am a huge fan of Longreads, which is a site that posts three or four wonderful links to excellent lengthy magazine pieces each day.

I also use Pocket to save any of these articles that I’d like to go back to in the future. I’ll usually peek at an interesting article when I see it and, if it looks good, I click the “pocket” button on my browser to save it.

If you happen to have a smart phone or a tablet, then you can read your Pocket articles on them, but you can just as easily do it in your browser. For me, it’s a great supplement to (and potential replacement for) many of the magazines that I’ve subscribed to over the years.

Got any questions? The best way to ask is to email me – trent at thesimpledollar dot com. I’ll attempt to answer them in a future mailbag (which, by way of full disclosure, may also get re-posted on other websites that pick up my blog). However, I do receive many, many questions per week, so I may not necessarily be able to answer yours.

Stay Away from Tourist Traps (343/365)

In 2004, I had the professional opportunity to travel to Mexico multiple times in a short span. On those trips, I had a few chances to visit some of the sights of rural Mexico.

One of the stops that really sticks in my mind is the opportunity to climb up a small Aztec pyramid at Teotihuacan. With some of my travel companions, we climbed up to the top of the pyramid, enjoyed the wonderful view, and also enjoyed the amazing architecture and design of these small pyramids.

Unfortunately, the primary path to reach these pyramids forced one to walk through a quarter of a mile or so of souvenir stands, all of which were hawking some kind of good. Since we were there as a large group, some people naturally finished with the pyramid tour before others and found themselves stuck standing there by all of these souvenir stands.

A few people wound up buying things from these souvenir hawkers. Those that did not were either drawn in to look or spend significant time trying to ignore them.

In either case, the souvenir hawkers produced a pretty unwanted – and in a few cases, expensive – effect on what was otherwise a wonderful vacation stop.

Thanks to Quinn Dombrowski for the photo

Thankfully, there are a few things you can do to avoid such tourist traps.

First, stick together as a group. Naturally, you’re going to have people who move at different paces in the group. If you find yourself wanting to move faster than the rest of your group, hang back for a moment and wait on them instead of charging ahead. Similarly, if you feel that everyone is waiting on you, hurry up a bit.

How does this help? If you all stick together as a group, you won’t be stuck at the souvenir or gift shop by yourself waiting on the rest of your group. Similarly, if you’re all together as a group, it becomes much easier to limit your time shopping for such souvenirs – or, better yet, skip them entirely.

Second, acquire memories, not stuff. If you want to remember your stop at an amazing place, take a lot of pictures. Record a bit of video. Write about it in your journal. Tell (and show) others about it. A great travel moment lives on in your mind and your heart, not your stuff.

Finally, bring back only things that matter. If you’re going to bring back a souvenir for someone, chances are you’re not going to find a cool souvenir in a souvenir stand in a touristy area. You’re going to find something much better off the beaten path in a place you didn’t expect.

If you’re planning on buying a gift for someone, put aside a bit of time to do just that and go to a place that’s genuinely local instead of just grabbing something less interesting from a souvenir stand. It will mean more, it will be far more interesting, and you’ll get more quality for the dollar.

Keep your dollars and spend them somewhere where you’ll get more meaning and value for your pennies. You’ll be glad you did.

This post is part of a yearlong series called “365 Ways to Live Cheap (Revisited),” in which I’m revisiting the entries from my book “365 Ways to Live Cheap,” which is available at Amazon and at bookstores everywhere.

What Seems Simple Rarely Is Simple

I enjoy watching cooking shows – you know, the ones where they actually focus on presenting a recipe and show off some of the techniques used in preparing that recipe.

My favorite cooking show host is Julia Child, by a fair margin. There’s something I’ve always found really comforting about her – I don’t quite know what it is. Anyway, here’s a prime example of her work, in which Julia prepares beef bourguignon in a classic episode of The French Chef:

I would not describe Julia Child as a truly expert chef. She is probably best described as a highly skillful amateur with a strong knack for presentation. Even so, she does have more than enough skill to prepare something like coq au vin or beef bourguignon from scratch.

When you sit down and watch an episode of The French Chef, you see enough of the steps and techniques for preparing the recipe that you can conceivably know how to do it in your head. It seems pretty straightforward, and you go away convinced that you could indeed prepare a pretty good beef bourguignon at home.

You know what the end goal is. You know what the basic steps are. It’s all very simple, right?

The first roadblock is that it’s impossible to show every detail of preparing a complex dish in a half hour program. You just can’t do it. Cooking show hosts tend to focus on just a few techniques from the recipe to show you – they simply can’t show every technique that they use. There isn’t time.

Still, someone who has spent some time in the kitchen can roughly fill in the blanks, right? I have enough skill that I could make a pretty solid shrimp etoufee in my kitchen if I saw a half hour cooking show on the recipe. Even given that, it would still be pretty challenging to make a good meal at this point.

The next roadblock – and this is a big one – is that completing something that seems simple still requires a lot of skill, subtlety, nuance, and continuous effort.

A few years ago, I pulled off an amazing coq au vin in my kitchen. Still, there were pretty big imperfections in my recipe. It was good – even very good – but it was still flawed.

The end lesson here is that even in things that seem incredibly simple and straightforward, it takes a lot to pull it off with excellence.

One of the most common things that home cooks are recommended to master is the simple scrambled egg. Can you scramble two eggs well? Even in that simple task, there are tons of techniques, talents, and efforts. In order to truly master even a simple scrambled egg, you must be skillful in many different areas.

Have you scrubbed your pan clean? Did you beat the eggs in a clean bowl? Did you wash the bowl properly first? Did you beat the eggs enough to mix them, but not so much to disturb the molecular composition of the egg whites? Have you turned up the heat to the proper level? Have you heated the pan enough, or is it too hot?

All of these questions – and we’ve not even put the eggs in the pan yet!

Here’s another example, in which Richard Paterson, a master blender of Scotch whisky, demonstrates some of the technique in maximizing enjoyment out of something as simple as drinking a bit of Scotch:

The things that seem simple rarely are, once you start digging into them.

This is absolutely true for personal finance.

The goal of personal finance is simple. You want to increase your net worth over time and provide financial security for yourself and for your family – that’s the goal for most people, anyway. It’s straightforward.

But how do you get there? Investing is one piece. So is frugality. So is self-reliance. So is psychology. The list goes on and on.

A person that’s successful at some areas can fail in others and everything will fall apart on them, much like a baker who remembers everything but the baking powder in a cake.

Within each of those areas, there’s a ton of technique as well. Every time a dollar crosses your fingers, you’re managing psychology. You’re managing time. You’re making buying decisions.

A person who succeeds at making a great meal isn’t perfect. They’re simply focused enough that they manage to perform all of the necessary tasks well enough to result in a successful meal. They might be particularly strong at some elements – say, making sauces – but they’re able to do other things well enough to achieve the result they want.

A person who succeeds at creating financial security isn’t perfect. They’re simply focused enough that they manage to perform all of the necessary tasks well enough to result in financial success. They might be particularly strong at some elements – say, frugality – but they’re able to do other things well enough to achieve the result they want.

A person who succeeds in either of these areas – or any area – is strong enough at the multitude of little things that they make it all come together and seem really easy.

For example, when you go into a store and focus on your grocery list, you’re not only saving money, you’re honing a better technique for shopping. You’re becoming a better personal financier by strengthening one technique, much like a person in the kitchen who chops vegetables for a few hours.

In a given day, I overcome temptation a lot of times. I make countless little decisions about how to spend my time. I’m often faced with lots of little purchasing decisions, too. I have to make sensible professional choices, and I also have to look for ways to improve other income streams, too. I have to stay focused along the way.

The end result – financial independence – is so simple and straightforward, but there are so many little techniques needed to get there. Each of those little techniques are very simple themselves, but it is the blend of all of those techniques that create the sweet taste of success.

The big thing seems simple, but when you look closer, it’s actually complex. So, instead, focus on the little things. You’ll find that eventually the big thing starts to fall right into place.

Consider All Forms of Transportation, Including Train and Bus (342/365)

A few months ago, I took a trip to Indianapolis. The first leg of the trip – a flight from Des Moines to Chicago – was uneventful, but it was the second leg that got interesting.

I was scheduled to fly from Chicago to Indianapolis, but my flight was cancelled, as was the subsequent flight. After some discussion with the ticketing agent, they essentially agreed to refund my ticket, leaving me in Chicago.

I then went to the local Greyhound bus station, caught a bus to Indianapolis, read my book on the way, and arrived about five hours after I left the airport. Total cost of the trip? $25.

While this wasn’t exactly the most optimal of trips, it did leave me thinking about how I could have used alternative means to plan a trip that maximized my time and my money.

Thanks to John Pastor for the image

My initial trip planning simply involved booking a flight to Indianapolis. I shopped around a bit, but what I didn’t do was consider the possibility of using other means of travel for one of the legs of the trip – or perhaps for the whole trip.

In fact, there are many opportunities to shave some dollars from your travel if you think outside the box a bit. Here are a few things to look for when planning travel.

Look for cheap flights that don’t involve layovers. Airlines will do all sorts of interesting things when pricing flights. If you can fly to Chicago for half the cost of flying to, say, Milwaukee or Indianapolis, consider just booking that flight and using other travel to finish your trip. The same goes for any cities within a few hours of each other, especially those connected by train.

Use a city’s metro system to easily connect bus stations, train stations, and (in large cities) multiple airports. For example, if you can find a very cheap flight to Chicago Midway, look into using the metro system to get over to O’Hare for another flight. I was able to connect a bus station to the airport by using Chicago’s metro system for just a few bucks.

Be flexible. This really works best if you’re traveling in a flexible fashion. Unless a trip is going to be a long one, I usually try to travel with just a carry-on, which makes it easy to jump from transport to transport.

Set a value for your time. It can be easy to find a cheap travel plan, but often that cheap plan chews up a lot of hours. What is your travel time actually worth? For example, are you willing to add an hour of travel time to save $15? How about $20? It all depends on what you value.

A little bit of creativity with travel can save you a lot of money if you plan ahead and think outside the box when it comes to travel options.

This post is part of a yearlong series called “365 Ways to Live Cheap (Revisited),” in which I’m revisiting the entries from my book “365 Ways to Live Cheap,” which is available at Amazon and at bookstores everywhere.

Ten Pieces of Inspiration #103

Each week, I highlight ten things each week that inspired me to greater financial, personal, and professional success. Hopefully, they will inspire you as well.

1. Quentin Crisp on career direction

It’s really tempting to switch careers, but sometimes it’s worth asking whether or not our skill set wouldn’t best be served staying put or choosing a third path.

“It’s no good running a pig farm badly for 30 years while saying, ‘Really, I was meant to be a ballet dancer.’ By then, pigs will be your style.” – Quentin Crisp

The skills we build in our life sometimes turn out to have more value than we think.

2. Paolo Cardini on monotasking

I find that whenever I multitask, the multiple tasks I do at once never get done very well.

This is fine if the tasks are truly unimportant… but if they’re so unimportant that I can’t bother with my full attention, why am I bothering at all?

3. Plato on wisdom and foolishness

If what you’re saying has no purpose, why are you saying it?

“Wise men talk because they have something to say; fools, because they have to say something.” – Plato

Save your words for something of worth.

4. Morning

The end of the year doesn’t feel like the end to me. It feels like the start of something new.

Thanks to Vince Alongi for the image.

5. Alfred Whitehead on diverse ideas

Ideas come from all kinds of places. The best ideas tend to be combinations of ideas. So, it’s not surprising that many unique great ideas come from unexpected combinations of sources.

“Novel ideas are more apt to spring from an unusual assortment of knowledge – not necessarily from vast knowledge, but from a thorough conception of the methods and ideas of distinct lines of thought.” – Alfred Whitehead

The more diversity you have in your knowlege, the more useful it becomes.

6. Thoreau on effort

Often, the journey is worth as much as the destination.

“Chop your own wood and it will warm you twice.” – Henry David Thoreau

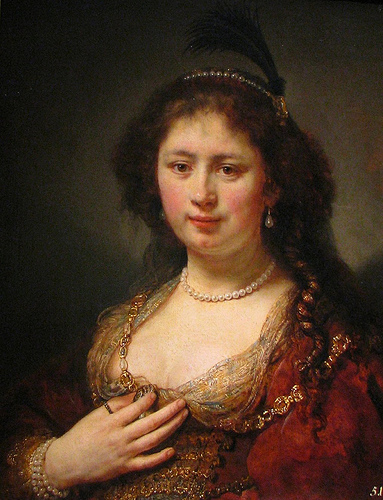

7. Rembrandt’s Lady with a Plume (1636)

There’s something deeply alive about the works of Rembrandt.

He had this astounding ability to bring a certain humanity to his subjects, as though you almost don’t want to look away lest the person in the painting break his or her pose and walk away.

8. Harlan Ellison on ignorance

An opinion that isn’t based on reason or fact isn’t really worth too much at all.

“You are not entitled to your opinion. You are entitled to your informed opinion. No one is entitled to be ignorant.” — Harlan Ellison

9. U2 – I Still Haven’t Found What I’m Looking For

I wore out my cassette copy of The Joshua Tree (the album this song appears on) in 1988 and 1989. I can still sing along to every word.

10. Ben Franklin on anger and shame

Find a channel for your anger that doesn’t destroy you or destroy others. You’ll be rewarded for it.

“Whatever is begun in anger ends in shame.” – Benjamin Franklin

Consider Camping (341/365)

When Sarah and I visited the Pacific Northwest for our first anniversary, we didn’t stay in a hotel for most of the vacation. We camped, using borrowed camping equipment, first on Mount Rainier and then in Olympia National Forest.

When we went on our first vacation after having our first child, we didn’t stay in a hotel for any of the vacation. We camped, using our own camping equipment, on the north shore of Lake Superior.

Almost every summer, we spend time camping. We camp in state parks. We camp on private land (with permission, of course). We camp in national parks.

It gets us outdoors. It gives us an abundance of time to enjoy the beauty of nature. It gives us an abundance of fresh air.

It’s also incredibly inexpensive once you have some basic equipment.

Photo courtesy Wisconsin Dept. of Natural Resources

You don’t even need that much equipment. The only devoted equipment you really need is a small tent and a sleeping bag for each person. Almost everything else we use when camping is repurposed from our kitchen or garage.

Very quickly, camping reduces our lodging cost for a night from a $100 hotel room to a $20 camping site. If we’re traveling, this is going to quickly become a major cost saver.

Instead of eating out for supper or breakfast, we bring our own food and cook it over a fire, saving us at least a bit of additional money.

When you’re camping, you’re often finding yourself at a state or national park that features abundant natural beauty or sights to see, so you’ll find yourself drawn naturally to those, which is an incredibly low-cost form of entertainment.

The end result is that you’ll find yourself finishing your vacation without the sad sensation of an empty wallet. Instead, you can go home well-rested and with money still in hand.

I enjoy camping enough that I would do it regardless of the savings, but the savings really provide some icing on the cake.

This post is part of a yearlong series called “365 Ways to Live Cheap (Revisited),” in which I’m revisiting the entries from my book “365 Ways to Live Cheap,” which is available at Amazon and at bookstores everywhere. Images courtesy of Brittany Lynne Photography, the proprietor of which is my “photography intern” for this project.

Confirmation Bias and You

Let’s say you’re worried that your finances aren’t being organized effectively. You’re not really sure what’s wrong, but you have a gut feeling about it. You decide to go to a financial advisor, who tells you that, indeed, your finances are in a bad place. He points out several perceived flaws and pledges that he can fix them.

Let’s say you’re leaning toward putting some of your money into an annuity. You do a few Google searches and, based on the results you find, it sure seems like buying an annuity is a really good idea.

Let’s say you’ve seen repeated advertisements and product placements that convince you that a particular product is really cool. You go into a store, see it on a well-designed display, and find yourself really wanting this item you don’t need. You sigh, decide that you can probably afford it, and head to the checkout aisle.

In each of these situations, confirmation bias is working against you. It’s guiding you toward a conclusion that is quite possibly not in your economic best interest.

What is confirmation bias? Confirmation bias is a tendency of people to favor information that confirms what they already believe. A person with conservative political leanings might believe in the accuracy of Fox News, for example, while a person with liberal political leanings might be an avid viewer of MSNBC. Both of these people will view their news source as unbiased and correct and view the other news source as farcical (I actually think they’re both farcical, but that’s a different subject entirely…).

Confirmation bias can be incredibly expensive. It can lead you to poor investment choices. It can lead you to extremism in your personal beliefs (which can be very alienating). It can lead you to poor spending decisions.

Naturally, confirmation bias is something you’re going to want to overcome most of the time. Whenever you’re making an important decision about your money or about something else you’re going to invest heavily in (such as a political movement), you owe it to yourself to figure out if confirmation bias is pushing you into this decision.

For me, the most effective tool at overcoming confirmation bias is unbiased information, particularly multiple sources of it. I try to look for sources of information that have no vested interest in anything but the accuracy of the data.

For example, an investment firm will have a vested interest in making their investment products look particularly good, so they’ll choose data points that will make their investments look great. I’ll want to look for other sources of information on investments.

On the other hand, places like Consumer Reports have a vested interest only in reporting reliable information about products. They don’t have a vested interest in one product selling well and another product selling poorly.

Sources I tend to trust include non-politicized government agencies (meaning ones that are staffed by people whose jobs don’t depend on the current administration or the result of elections) and independently-funded review and comparison organizations (like Consumer Reports for consumer products or Morningstar for investment options).

(It’s important to note that many people who prey on confirmation bias want to undermine unbiased information. They’ll attack the source of a piece of unbiased information rather than looking at what the information itself is saying. If you’re going to pay attention to such attacks, you must find out for yourself whether those attacks have any justification or not.)

Beyond that, I always value data that comes from many different sources. If I can’t find data that comes from an unbiased source, I try to find data from sources that would have different biases.

For example, when I’m making up my mind on a political story, I’ll read an article on it from a fairly conservative source and then read an article on it from a fairly liberal source. The elements that the stories have in common are generally the ones that are reliable, while everything else is highly suspect.

The more important a decision is, the more sources of information I’m going to want. I most highly value unbiased sources of information, but I’m often forced to include some sources of biased information, so I do my best to balance them.

If the data tells me that my initial hunch was wrong, then I’m willing to say I’m wrong. This is absolutely vital. You must be able to walk away from the ideas you have if the data proves you wrong. If you cannot do that, then you will repeatedly fall prey to confirmation bias.

What’s the take-home message here? When you have an important decision, research it. Find unbiased sources of information. Find information with conflicting biases – one on one side and one on the other. Compare them all and see what idea really does come out on top, and then go with the one that’s actually backed up by data.

If you make major financial moves based on a hunch that was reinforced by a salesman or the first two results of your Google search, you’re going to find yourself on the losing end of the deal more often than not. Take your time and find many sources of real information before you make a move.

My new book, The Simple Dollar: How One Man Wiped Out His Debts and Achieved the Life of His Dreams, is available in bookstores now! Check out some of the

My new book, The Simple Dollar: How One Man Wiped Out His Debts and Achieved the Life of His Dreams, is available in bookstores now! Check out some of the